Climate change is affecting the planet in more ways than we can imagine. It is impacting weather patterns, causing extreme climate events and affecting lives and livelihoods across the world. These changes have increased the risks faced by farmers, making agriculture more unpredictable. To reduce this uncertainty, governments and financial institutions have introduced various forms of agricultural insurance. Among these, the comprehensive crop insurance scheme is recognised as one of the most effective tools to safeguard farmers against unforeseen losses.

This blog explains what a comprehensive crop insurance scheme is, the principles behind it, what it covers, and how crop insurance works in practice.

- Buy in easy steps

- Premium Starts at INR 499

- Protect 100+ Crops

- Quick & Easy Claims

Understanding the Concept of Crop Insurance

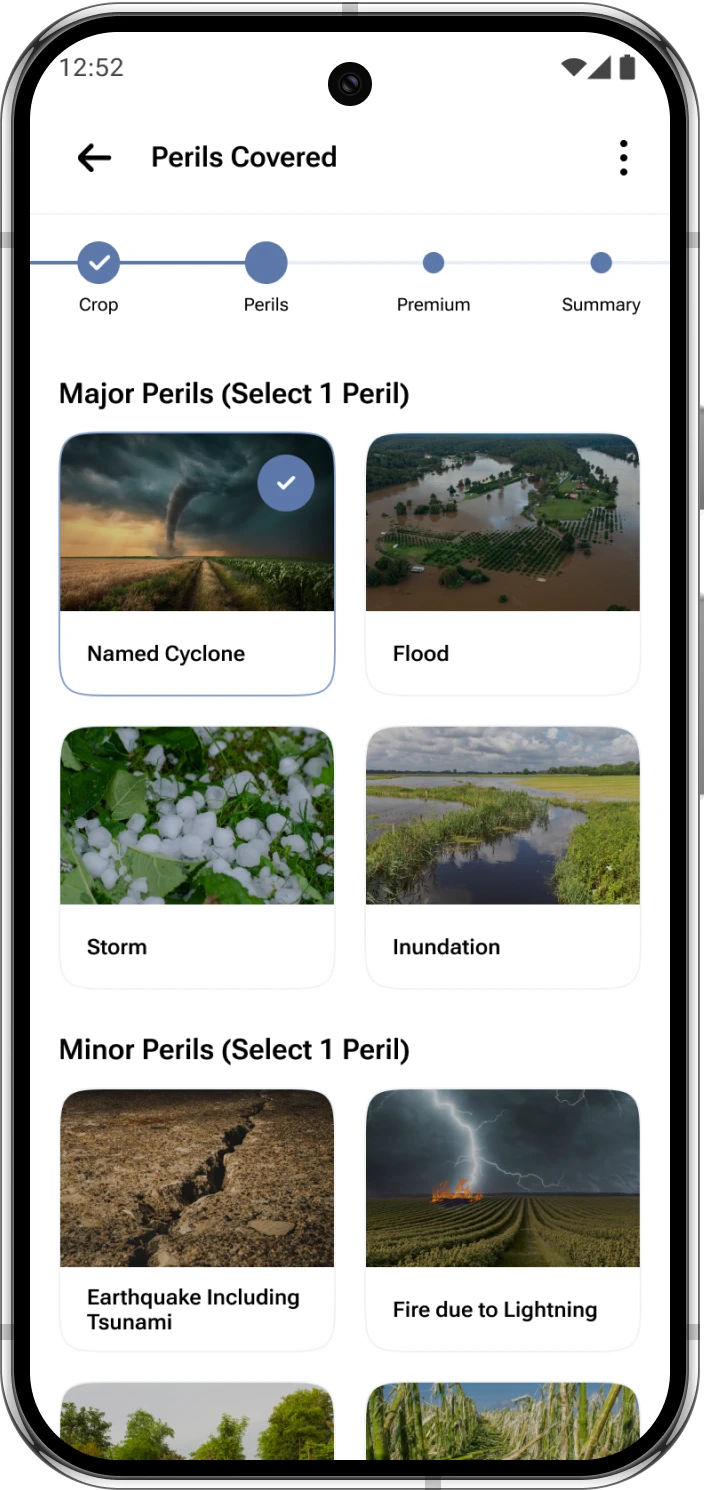

Crop insurance acts as a financial shield for farmers. When crops are damaged due to reasons beyond the farmer’s control—such as floods, droughts, cyclones, landslides, hailstorms etc.—the insurance compensates for the loss. Farmers pay a small premium, and in return, receive protection against major risks. Not all crop insurance policies are the same; while some cover only one or two perils, a comprehensive scheme offers broader protection, ensuring farmers are better safeguarded from multiple threats.

What Makes a Scheme “Comprehensive”?

A comprehensive crop insurance scheme differs from basic insurance in its scope. Instead of focussing on one or two risks, it typically includes:

- Weather-related risks: Excessive or unseasonal rainfall, floods, hailstorms, and cyclones drought etc.

- Biological risks: Pest attacks, plant diseases, and infestations.

- Market-related risks: In some cases, schemes may even cover price fluctuations that affect farmers’ income.

- Regional adaptability: Insurance policies or solutions are often tailored to local conditions, recognising that risks vary across regions.

By encompassing multiple threats, the scheme ensures that farmers are not left exposed to gaps in protection. This is why many governments schemes promote the comprehensive crop insurance scheme as a cornerstone of agricultural policy.

Why Farmers Need It

Farming is unlike most other professions. A factory can control its production environment, but a farmer cannot control the weather. Even with modern technology, agriculture remains vulnerable. Without insurance, a single failed harvest can push a farming family into debt or poverty.

Farming depends heavily on the weather, and even one extreme event can destroy an entire harvest. Without insurance, a single crop failure can push farmers into debt. A comprehensive crop insurance scheme provides financial support during such losses, giving farmers the confidence to invest in better seeds, fertilisers and modern technology. With stable income protection, farmers can continue farming without fear of unexpected disasters.

How Crop Insurance Works in Practice

To understand how crop insurance works, let’s break down the process step by step:

- Premium Payment Farmers enrol in the scheme by paying a premium. In many countries, governments subsidise these premiums to make them affordable.

- Risk Assessment Insurance providers assess the risks associated with specific crops in particular regions. For example, rice grown in flood-prone areas may attract a different premium compared to wheat grown in arid zones.

- Monitoring and Data Collection Modern schemes rely on satellite imagery, weather stations, and field surveys to monitor crop conditions. This ensures accurate assessment of losses.

- Claim Settlement If crops fail due to covered risks, farmers file claims. The insurer verifies the extent of damage and compensates accordingly.

This process illustrates how crop insurance works as a structured mechanism to reduce uncertainty in farming.

Crop Insurance Coverage Explained

The term crop insurance coverage refers to the extent of protection offered under a policy. In a comprehensive crop insurance scheme, coverage is broad and inclusive. It may include:

- Yield-based coverage: protects farmers when actual crop yield falls below the expected yield.

- Weather-based coverage: Provides automatic payouts when weather conditions move beyond set limits.

- Area-based coverage: measures losses at a broader level such as village or district, reducing disputes and ensuring fairness.

By offering comprehensive crop insurance coverage, Together, these coverage types give farmers full protection from the most common agricultural risks.

Benefits of a Comprehensive Crop Insurance Scheme

- Financial security: Farmers are protected against catastrophic losses.

- Encouragement of investment: With reduced risk, farmers are more willing to adopt modern farming techniques.

- Stability in rural economies: Insurance prevents sudden income shocks that can destabilise communities.

- Government support: Subsidised premiums make the scheme accessible to small and marginal farmers.

Challenges and Limitations

- Awareness: Many farmers are unaware of the scheme or do not understand how crop insurance works.

- Implementation hurdles: Accurate data collection remain problematic in some regions.

- Affordability: Even subsidised premiums may be difficult for the poorest farmers to pay.

The Future of Crop Insurance

Technology is transforming agriculture, and insurance is no exception. Satellite monitoring, mobile apps are making schemes more efficient and transparent. The future of the comprehensive crop insurance scheme lies in integrating these innovations to provide faster, fairer, and more reliable support to farmers.

Governments and insurers are also exploring ways to expand crop insurance coverage to include income protection, ensuring farmers are shielded not just from crop failure but also from volatile market prices.

Use the Department of Agriculture & Farmers Welfare – Crop Insurance Division page (official overview of India’s crop insurance framework/PMFBY).

Conclusion

A comprehensive crop insurance scheme is more than just a policy—it is a lifeline for farmers. By covering multiple risks, it protects livelihoods and provides stability in an uncertain environment. Understanding how crop insurance works helps farmers appreciate its value, while broad coverage ensures they are protected from major threats. As climate change continues to affect agriculture, the importance of comprehensive crop insurance will only increase. Solutions like Kshema’s Prakriti further support this effort, helping farmers stay secure and confident throughout the cropping season.

Frequently Asked Questions

1. What is a comprehensive crop insurance scheme?

It is an insurance policy that protects farmers from multiple risks—such as drought, flood, cyclones, pests and diseases—under a single plan. It offers complete protection instead of covering only one or two risks.

2. How does crop insurance work?

Farmers pay a premium to enrol. Insurance providers monitor the crop using technology. If crops are damaged due to insured risks, a claim is filed, and compensation is paid after verification.

3. What does crop insurance coverage include?

Coverage typically includes weather risks like drought and heavy rainfall, biological risks such as pest attacks and plant diseases, and in some schemes, income-related risks.

4. How are crop losses verified today?

Losses are measured using satellite imagery, weather station data, field surveys and digital tools. These methods ensure quick and accurate verification.

5.Why should farmers choose comprehensive coverage?

It protects them from multiple risks, reduces financial stress, supports better farming decisions and stabilises income across uncertain seasons.