Crop Insurance: Protecting Crops and Farmers from Extremities

Protecting your crop has become essential because farmers now face sudden weather changes, pest attacks and climate driven disasters. Even a small loss can affect a farmer’s entire income. Crop insurance helps protect your crop from these extremes by offering financial support when damage occurs. This guide explains why protection is necessary, what perils are covered and how Kshema’s insurance solutions safeguard farmers during difficult times.

- Buy in easy steps

- Premium Starts at INR 499

- Protect 100+ Crops

- Quick & Easy Claims

Extreme weather events like heavy rainfall, drought, hailstorms, frost and high winds can destroy standing crops within hours. In many regions, wild animal attacks, soil erosion and unexpected temperature drops also reduce yields. Farmers often have no way to predict or control these extremities, which is why strong crop protection becomes essential.

Lower yield and the threat of harsh weather are among the major reasons for crop loss.

Even though the performance of the agriculture and allied sector has been buoyant over the past several years, much of which is on account of the measures taken by the government to augment crop productivity, ensuring certainty of returns to the farmers through price support, promote crop diversification, improve market infrastructure through the impetus provided for the setting up of farmer-producer organisations and promotion of investment in infrastructure facilities, yet agriculture remains one of the most uncertain among the major forms of livelihood.

Why Opt for Crop Insurance?

In this dynamic domain of agriculture where unpredictable weather patterns and unforeseen calamities pose constant threats to a farmer’s livelihood, having a reliable crop insurance is paramount.

Among the many options available in India, Kshema’s Crop Insurance stands out as a trusted name in safeguarding the farmers against crop losses.

Understanding Kshema’s Insurance Policies for Crops:

Kshema’s Crop Insurance offers comprehensive coverage tailored to the specific needs of Indian farmers. With a deep understanding of the challenges faced by agricultural communities, we provide specialized insurance solutions to mitigate risks associated with crop cultivation right from the sowing to the harvesting phase.

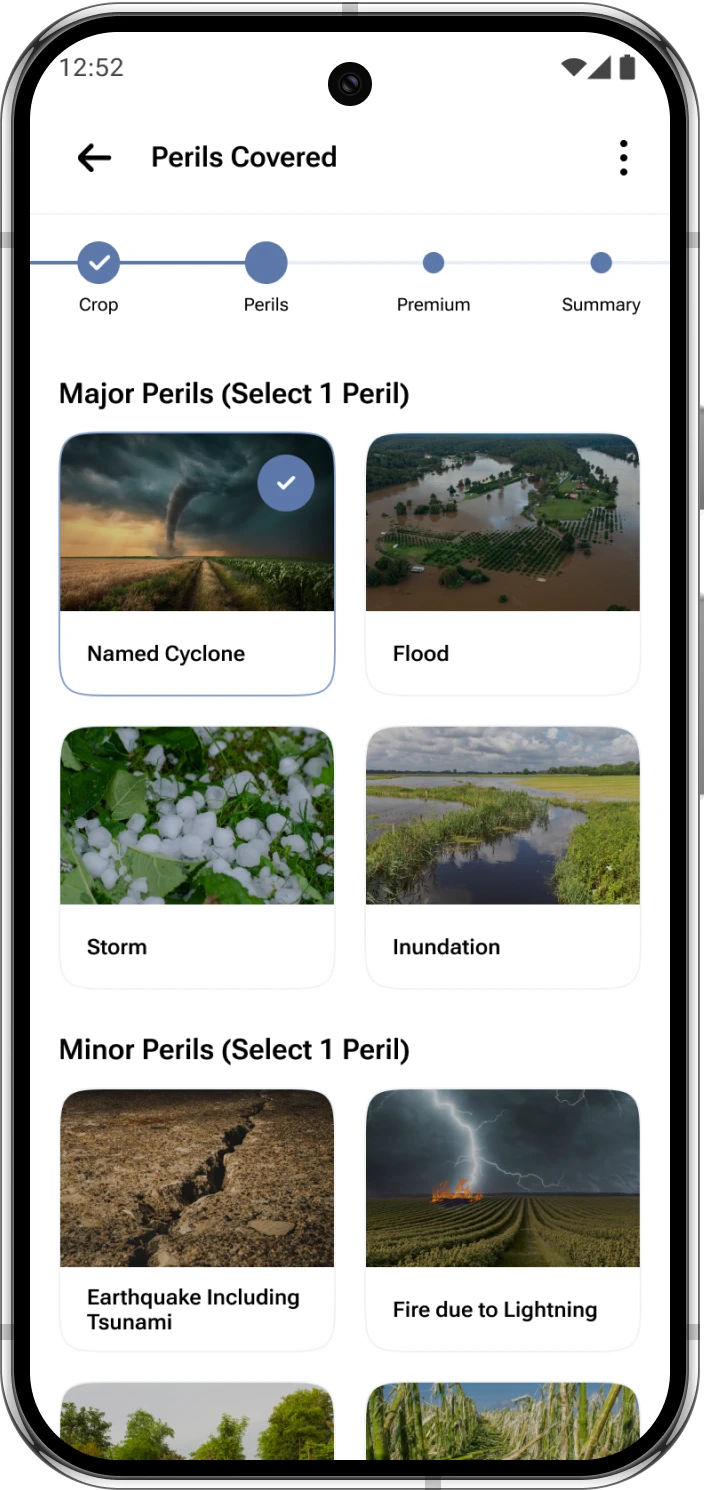

Whether it is natural perils like flood, earthquake and hailstorm or accidental perils like airplane damage, Kshema Prakriti policy protects farmers against nine major natural and accidental perils that commonly damage crops across India, our customizable policy Kshema Sukriti ensures affordability by letting the farmer choose protection against 2 among these perils.

Benefits of Kshema Crop Insurance : Protect Your Crop and Livelihood

Our aim is that the farmers have the support they need to safeguard their investments and livelihoods in all possible adversities. The major benefits of Kshema Insurance include:

Financial Security:

Kshema Crop Insurance provides farmers with financial protection in the event of crop failure or damage due to 9 covered perils. This ensures that farmers can recover their losses and sustain their livelihoods even during challenging times.

Customized Coverage:

- Unlike generic insurance plans, Kshema offers tailored coverage option through Kshema Sukriti policy that lets the farmer choose two perils that they think might have the highest occurrence probability in their region at an affordable cost of just Rs 499/acre.

Covering 100+ crops:

- Crop insurance policies by Kshema cater to the diverse needs of farmers across different regions and crop types. From traditional crops like rice and wheat to specialty crops, Kshema ensures that farmers can choose the coverage that best suits their requirements.

Timely Settlements:

- One of the key benefits of choosing Kshema Crop Insurance policies is our prompt and hassle-free claim settlement process. With a dedicated team of experts and a robust claims management system, Kshema ensures that farmers receive their payouts quickly, allowing them to resume their agricultural activities without undue delay.

By choosing Kshema, farmers gain transparent coverage, region-based protection and a simple claim process, helping them restart farming quickly after any crop loss.

The Process of Buying and Availing Kshema Crop Insurance Policies:

You can buy our crop insurance policies in 3 simple steps:

Step 1: Register Easily on the Kshema App

Step 2: Map Your Farm With the Polygon Tool

Step 3: Pay Premium and Get Instant Policy Issue

Farmers interested in availing Kshema Insurance can register online through the I-Agri app available on Playstore. The registration process is simple and requires basic information.

Polygon mapping:

Once the registration is done, the farmer needs to mark his cropland with a virtual polygon on the given map of his area.

Premium Payment:

After filling out some details, the farmer can pay the premium amount based on the coverage opted and the assessed risk. Kshema offers flexible payment options, including online payments and bank transfers.

Upon successful premium payment and verification of the information provided by the farmer, Kshema issues the insurance policy to the farmer, outlining the terms, coverage limits, and claim procedures. It is essential for farmers to review the policy document carefully and keep it handy for future reference.

Quick Claims Settlement

In the event of crop loss or damage, farmers can file a claim with Kshema Insurance by submitting the necessary documents, such as crop cutting reports, yield estimates, and proof of loss. Kshema evaluates the claim promptly and disburses the settlement amount to the farmer’s account upon approval.

Choosing the Best Crop Insurance Provider in India:

With various crop insurance options in market, selecting the best crop insurance that fulfills their specific needs can be a daunting task for the farmers.

However, Kshema’s Crop Insurance emerges as a frontrunner in the realm of crop insurance, offering comprehensive coverage, personalized options, and innovative solutions to safeguard the farmers from financial resilience. By understanding the benefits and process of Kshema Insurance, farmers can make informed decisions to protect their crops and secure their future harvests.

With Kshema by their side, farmers can cultivate with confidence, knowing that their investments are protected against unforeseen risks and uncertainties.

Conclusion

Protecting your crop is essential to secure your income from sudden weather changes and natural disasters. Kshema’s crop insurance policies offer farmers strong, simple and affordable protection. With quick enrolment and transparent claims, farmers can recover faster and continue farming confidently. Explore the Kshema App to protect your crop and safeguard your next season.

Also Read: https://www.reinsurancene.ws/tag/kshema/

Frequently Asked Questions on How to Protect Your Crops

1. Why should I protect my crop from extremities?

Because weather, pests and unexpected disasters can reduce yield and income instantly.

2. What does crop insurance usually cover?

Flood, cyclone, hailstorm, lightning, earthquake, wild animal attacks and more.

3. How much does crop insurance cost?

Pricing varies by crop and region; Kshema offers affordable plans from ₹499 per acre.

4. How can I buy Kshema crop insurance?

Download the Kshema App, register, map your farm and pay the premium.

5. How fast are claims processed by Kshema?

Farmers can upload photos/videos and receive quicker settlement through app based processing.