Climate Change: A Growing Risk for Farmers

Climate change is making farming more difficult every year. Unpredictable rainfall, heatwaves, droughts and storms now cause sudden crop losses for farmers across India. To protect their income during these climate risks, farmers increasingly rely on crop insurance. This guide explains how climate change affects crop production and why crop insurance is essential for safeguarding a farmer’s earnings and future.

- Buy in easy steps

- Premium Starts at INR 499

- Protect 100+ Crops

- Quick & Easy Claims

How Climate Change Impacts Crop Production

Climate change is creating sudden rainfall, dry spells, heatwaves and storms that damage crops like rice, wheat, maize and pulses. India has already lost millions of hectares due to droughts and floods in recent years. As temperatures rise, farmers face unpredictable yields, reduced income and higher risks every season.

- rainfed rice yields may reduce marginally (2.5%) by 2050 and 2080

- irrigated rice yields could decrease by 7% (2050) and 10% (2080)

- wheat yield may reduce by 6-25% by 2100

- maize yields by 18-23% by 2100

According to a study, India lost 33.9 million hectares of cropped area due to floods and excess rains between 2015 and 2021. Additionally, 35 million hectares were lost due to drought. The ICAR conducted a vulnerability assessment of agriculture in 573 rural districts of India and 109 districts fall under the “very high risk” category while 201 districts are in the “risk category”, putting the focus squarely on weather management.

It is evident that extreme climate events are becoming more intense and frequent, disproportionately affecting agricultural activity and production. This will push more farmers into debt resulting in poverty.

Why Crop Insurance Is Vital in a Changing Climate

Even with modern forecasts, no farmer can control sudden weather events. Crop insurance acts as a financial shield, providing compensation when climate events like drought, hailstorm or intense rainfall damage crops. This ensures farmers do not lose their entire seasonal income.

Weather Insurance for Farmers

Climate change has increased demand for weather insurance that protects farmers from rainfall shortage, excess rain, frost, heatwaves and storms. Weather-linked insurance offers protection based on climate triggers, helping farmers recover even when no physical crop inspection is possible.

Kshema Sukriti: Smart Protection Against Weather Risks

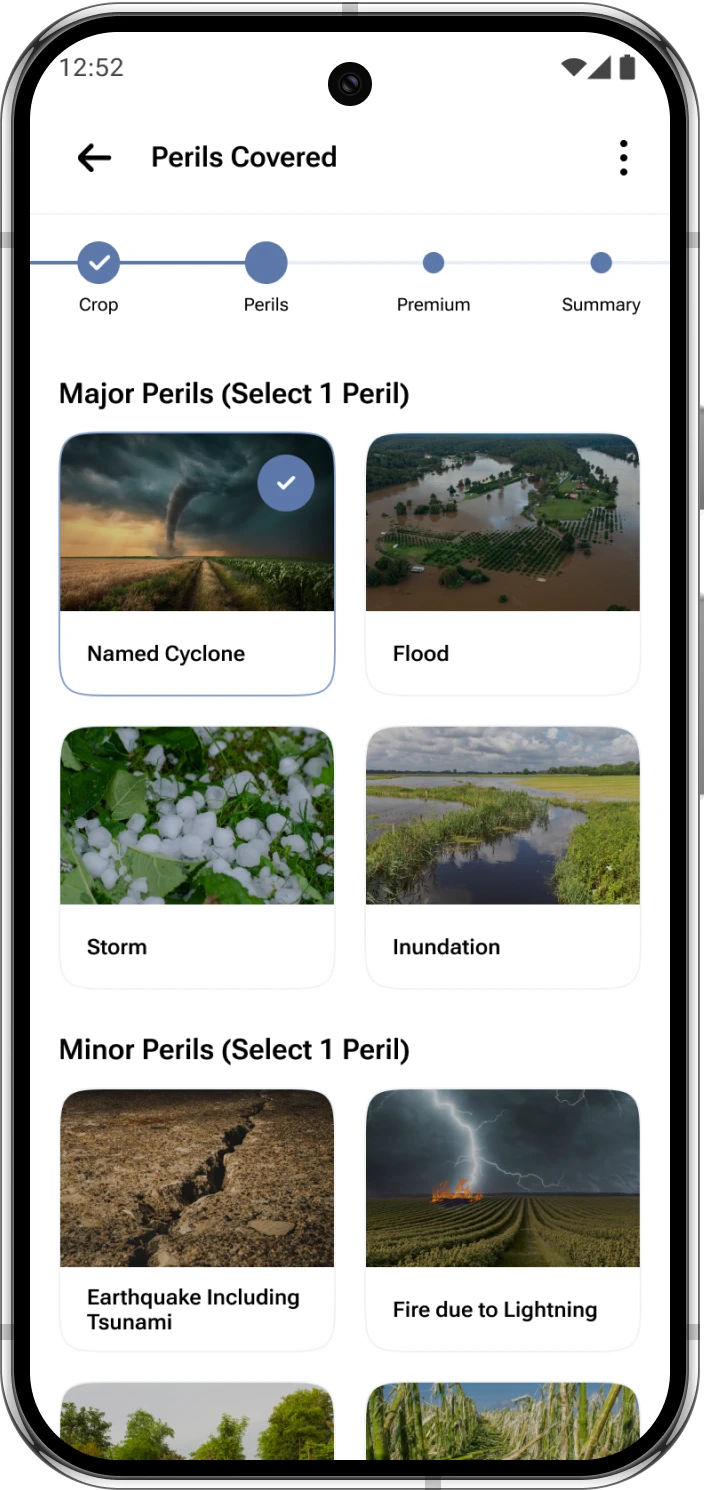

Kshema Sukriti, a pioneering crop insurance solution helps farmers build a financial safety net. Starting from Rs 499 per acre, Sukriti is a customisable crop insurance solution that protects more than 100+ crops. Farmers can choose to insure their crops with a combination of perils – one major and one minor – from a predetermined list of nine perils. This flexibility ensures farmers choose the combination of perils that is most likely to affect their crop based on climate, region, location of their farm, historical pattern etc.

The major perils covered are cyclone, inundation (not applicable for hydrophilic crops), flood, hailstorm while the minor perils include earthquake, landslide, fire due to lightning, animal attack (monkey, rabbit, wild boar, elephant) and damage due to aircraft.

Farmers also have the option of enhancing the sum insured in this unique crop insurance solution by paying additional premiums to safeguard their financial interest. A farmer can buy Sukriti crop insurance by registering on the Kshema app from the comfort of their home. They can even submit claims on the app by uploading policy details and photos or videos of the damaged crop. Kshema deploys technology like geo-tagging, satellite imagery, AI-based algorithms etc. to ensure speedy settlement of claims for both Sukriti and Prakriti crop insurance solutions.

This flexibility allows farmers to select coverage based on actual weather patterns in their village. By choosing the right peril combination, farmers gain targeted protection against the most likely climate risks affecting their crop.

Crop insurance: A necessity

Crop insurance solutions not only secure financial interests of farmers but over time they lead to higher investment and better practices in agriculture, leading to overall growth of the sector.

Therefore, it is imperative that farmers buy crop insurance along with seeds, fertilisers, equipment etc during every agricultural season to save their income from any adverse climatic event and start their journey towards prosperity.

Frequently Asked Questions on Crop Insurance

1. How does climate change affect crop production?

It causes unpredictable rain, heatwaves and droughts that reduce crop yield.

2.Why do farmers need crop insurance during climate change?

It protects their income when weather-related crop loss occurs unexpectedly.

3. What insurance is suitable for climate-affected farmers?

Peril-based plans covering drought, excess rain, flood and hail are ideal.

4. How does technology help in crop insurance?

Satellite images and mobile apps enable faster, more accurate claim settlement.

5. Does weather insurance support farmers financially?

Yes, it compensates farmers when weather variations damage crops.