ESG‑Focused Risk Assessment Model: Frameworks for Sustainable Growth

At Kshema we have a proprietary framework that fundamentally and systematically includes location aware ESG issues in risk analysis and shape our value decisions.

This allows us the benefit of drawing evidence-based results as opposed to heuristic decision making.

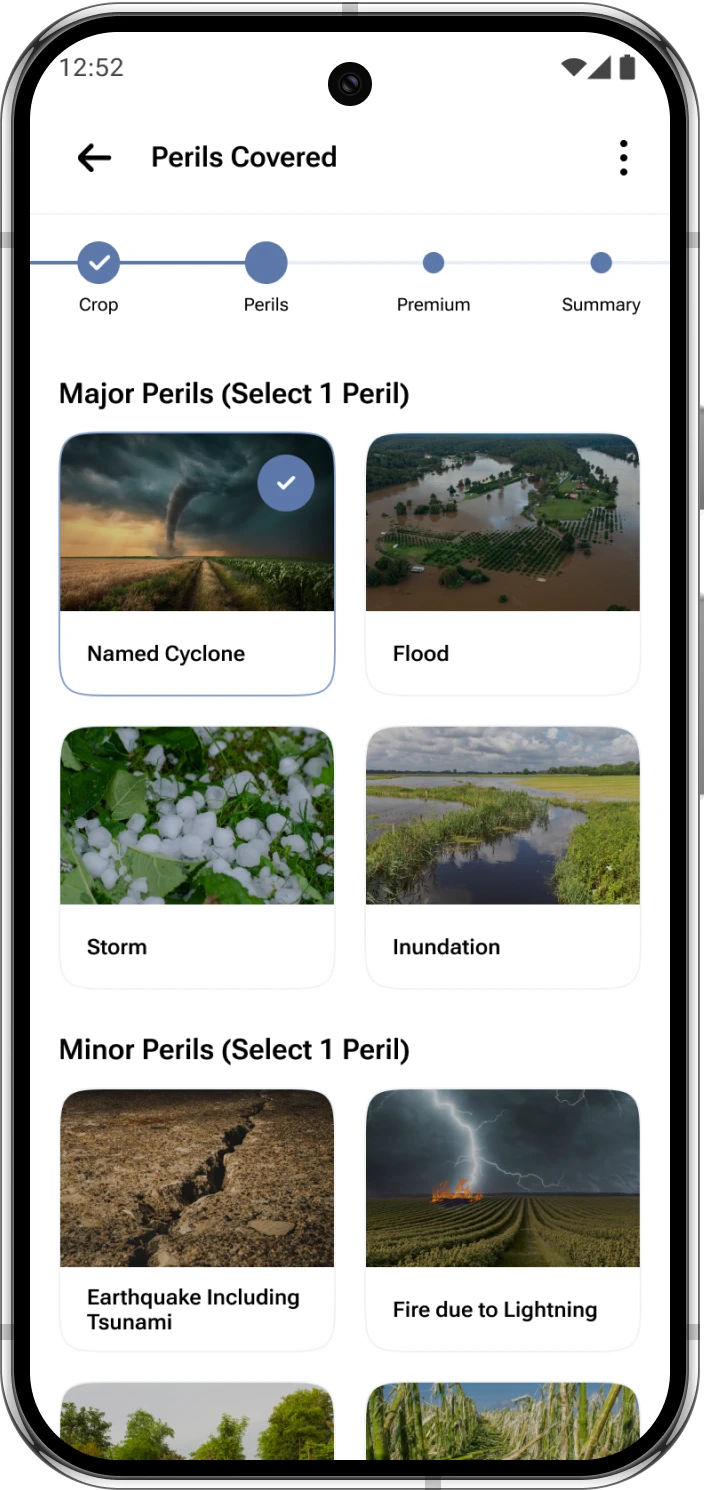

- Buy in easy steps

- Premium Starts at INR 499

- Protect 100+ Crops

- Quick & Easy Claims

The framework allows us additional lens to assess risk evaluation over and above traditional fundamental methods.

More importantly it is a unique approach that harnesses proprietary tools with the objective of increasing confidence, extending protection to more stakeholders by extending the analytical scope beyond traditional risk analysis and helps over the medium to long term.

Kshema is our proprietary location aware ESG tool that allows us to profile risk across all the grids encompassing every micro climatic zone in the country effectively covering our entire potential customer base.

It was built through collaboration of multiple Kshema partners who are individual and institutional subject matter experts from across the globe.

An integrated approach enables the efficient risk profiling by ensuring material ESG risk and opportunities are adequately priced into insurance decisions.

When these risks are properly priced into the premiums – that is our opportunity to build long term sustainability for our investors and customers.

Frequently Asked Questions on ESG‑Focused Risk Assessment Models

1. What is an ESG‑focused risk assessment model?

It is a structured framework that evaluates environmental, social, and governance risks to help businesses ensure compliance, sustainability, and resilience.

2.Why is ESG assessment important for businesses?

ESG assessments identify risks like climate impact, labor practices, and governance gaps, helping companies build trust and attract responsible investors.

3. How does an ESG‑focused risk assessment model work?

It uses frameworks, data analytics, and materiality assessments to measure ESG risks, prioritize issues, and guide sustainable decision‑making.