Farmers face unpredictable weather, rising costs and uncertain markets. A single flood, drought or pest attack can end an entire season’s effort. This is where insurance becomes essential. The benefits of insurance to farmers go beyond compensation—they provide stability, confidence and long‑term security. Insurance helps protect crops, livestock, machinery and income, allowing farmers to continue their operations even after major losses. In this guide, we explain the key benefits of insurance to farmers, importance and real‑life impact of insurance on rural livelihoods.

- Buy in easy steps

- Premium Starts at INR 499

- Protect 100+ Crops

- Quick & Easy Claims

Understanding the Benefits of Insurance to Farmers

The benefits of insurance to farmers extend far beyond simple compensation for losses. It provides peace of mind, allowing farmers to focus on productivity rather than constantly worrying about risks. Rural insurance products such as crop insurance, livestock insurance, and warehouse or equipment insurance safeguard farmers against financial shocks.

For instance, crop insurance protects against losses from droughts, floods or pest infestations. Livestock insurance covers diseases or accidents that affect animals, while machinery insurance ensures that costly equipment can be repaired or replaced without heavy financial pressure. Together, these measures provide financial security for farmers, enabling them to continue their work even in adverse conditions.

The Importance of Insurance for Farmers in Modern Times

The importance of insurance for farmers has grown significantly in recent years. Climate change has made weather patterns more unpredictable, increasing the frequency and intensity of extreme events. Farmers relying solely on traditional risk‑management methods often struggle to cope.

Farmers today face greater risks than ever—from erratic monsoons to rising pest attacks. Insurance provides a reliable way to handle these uncertainties. With crop, livestock and equipment coverage, farmers can immediately recover losses without depending on loans or selling assets. This creates resilience across rural communities and supports long-term agricultural growth.

Insurance offers a structured solution. By paying a relatively small premium, farmers gain access to claims that can protect them from financial ruin. This benefits not only individual farmers but also strengthens the agriculture sector. Insured farmers are more likely to invest in modern techniques, adopt sustainable practices and contribute to national food security while supporting the rural economy.

Financial Security for Farmers: A Key Benefit

A major benefit of insurance to farmers is the financial security it provides. Farming requires high investment in seeds, fertilisers, machinery and labour. A single disaster can wipe out these investments, pushing farmers into debt.

Insurance reduces this risk by ensuring that farmers receive compensation when losses occur. This financial stability helps farmers plan better for the future. They can take loans confidently, knowing insurance protects them if things go wrong. Banks and financial institutions also view insured farmers as lower‑risk borrowers, making credit easier to access. In this way, insurance helps promote growth and resilience in rural economies.

Encouraging Innovation and Sustainability

Another overlooked benefit of insurance to farmers is its role in encouraging innovation. Insured farmers are more willing to experiment with new crops, techniques or technologies because they know that insurance can cushion the impact if things do not go as expected.

This support is vital for sustainable agriculture. With insurance behind them, farmers can adopt eco‑friendly practices such as organic farming, water conservation and renewable‑energy use. These practices help the environment while ensuring long‑term productivity and profitability.

Reducing Stress and Improving Well-being

The importance of insurance for farmers is not just financial. Farming is a stressful occupation, with livelihoods dependent on factors beyond human control. Insurance reduces this stress by offering a safety net. Farmers who know they are protected experience greater peace of mind, improving their mental and physical well‑being.

This improvement extends to families as well. Children can continue their education without disruption, and communities thrive when farmers are stable. Insurance therefore contributes to both social and economic development.

Government Support and Policy Implications

Governments recognise the benefits of insurance to farmers and often provide subsidies to make insurance more affordable. Public–private partnerships help expand coverage, ensuring even small or marginal farmers can access insurance.

The importance of insurance for farmers is also reflected in national food‑security policies. By protecting farmers against risks, governments ensure steady agricultural production, even during crises. Strong insurance adoption supports supply chains and helps prevent food shortages.

According to the Food and Agriculture Organization (FAO), expanding access to farmer insurance is essential for building climate‑resilient rural communities.

Case Studies: Real-world Impact

Consider a farmer who loses his entire crop due to sudden flooding. Without insurance, he faces debt, poverty and possibly the loss of his land. With crop insurance, he receives the compensation needed to replant and recover.

Similarly, livestock farmers benefit when diseases or accidents occur. Insurance allows them to replace animals and continue production. These real-life examples highlight the financial security for farmers that insurance provides, supporting livelihoods and communities.

Challenges and the Way Forward

Although the benefits of insurance to farmers are clear, challenges remain. Many farmers are unaware of available schemes or find premiums unaffordable. Some face delays or complexities when filing claims. Addressing these issues requires greater awareness, simplified processes and strong government support.

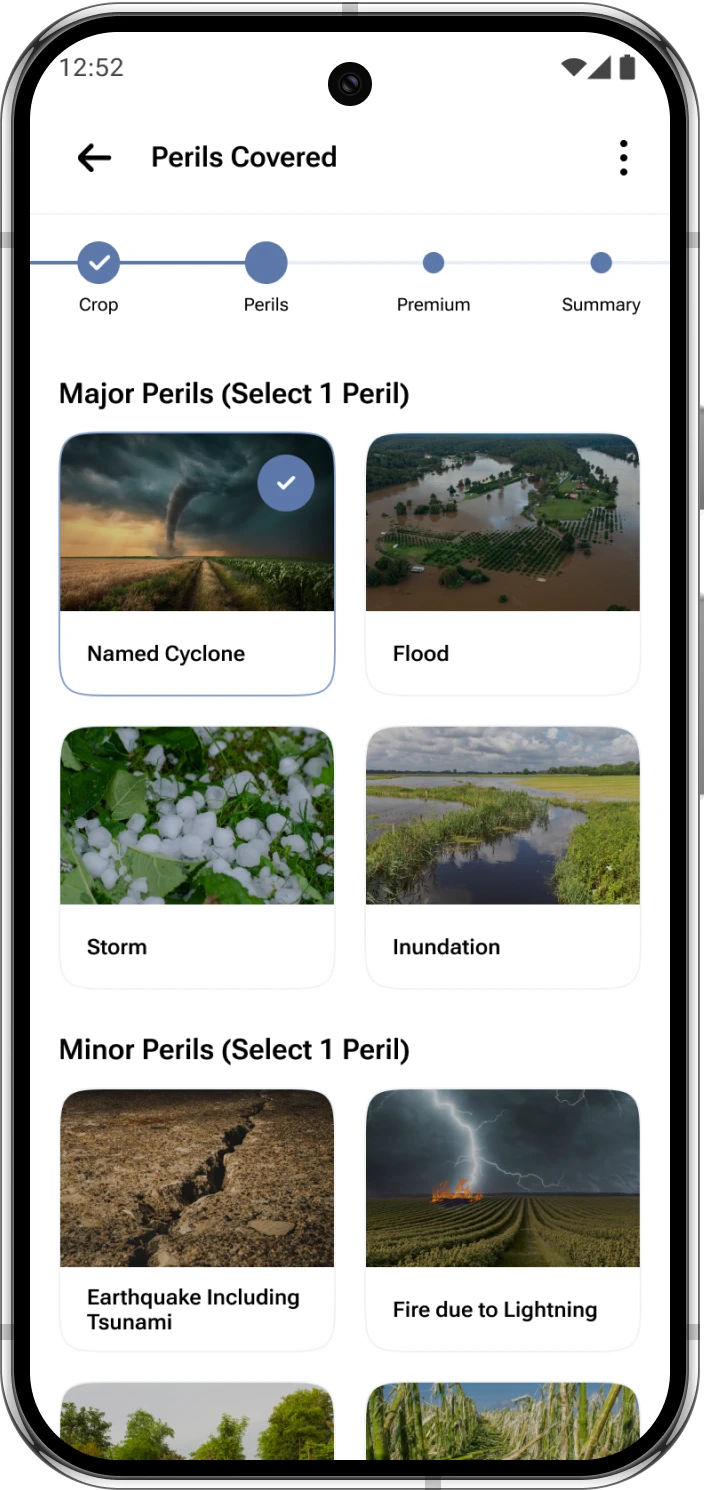

Technology can also help. Mobile apps and digital platforms make it easier for farmers to enrol, pay premiums and file claims. As such tools grow, the importance of insurance for farmers will continue to increase.

Conclusion

The benefits of insurance to farmers range from financial protection to stress relief. In today’s environment of climate uncertainty and economic volatility, insurance is not a luxury but a necessity. It provides financial security, encourages innovation, supports sustainability and strengthens communities.

The importance of insurance for farmers lies in its ability to turn agriculture into a more stable and rewarding livelihood. By expanding access and addressing current challenges, we can build stronger, more resilient farming systems for the future.

Frequently Asked Questions

1. What are the main benefits of insurance to farmers?

Insurance protects farmers from unexpected losses and gives financial support, helping them continue farming even during difficult situations.

2. Why is insurance important for farmers today?

Weather changes and rising risks make farming uncertain. Insurance gives farmers safety, stability and confidence to manage losses.

3. How do the benefits of insurance to farmers improve financial security?

Insurance helps farmers recover money after losses, reduces debt risk and supports better planning for the next farming season.

4. How does crop insurance support the benefits of insurance to farmers?

Crop insurance covers damage from floods, droughts and pests, helping farmers replant quickly and avoid financial stress.

5. How can small farmers experience the benefits of insurance to farmers?

Small farmers benefit through low‑cost plans, government support and easy claim processes that protect them during tough times.