- Buy in easy steps

- Premium Starts at INR 499

- Protect 100+ Crops

- Quick & Easy Claims

Why Crop Insurance Matters in 2025

1. Understand Your Risks and Coverage Needs

The first step in choosing a crop insurance policy is understanding the specific risks faced by your farm. Different regions experience different types of risks, such as drought in arid areas or flooding in monsoon-prone areas. Assessing the history and likelihood of these risks can help you determine the level of coverage you need.

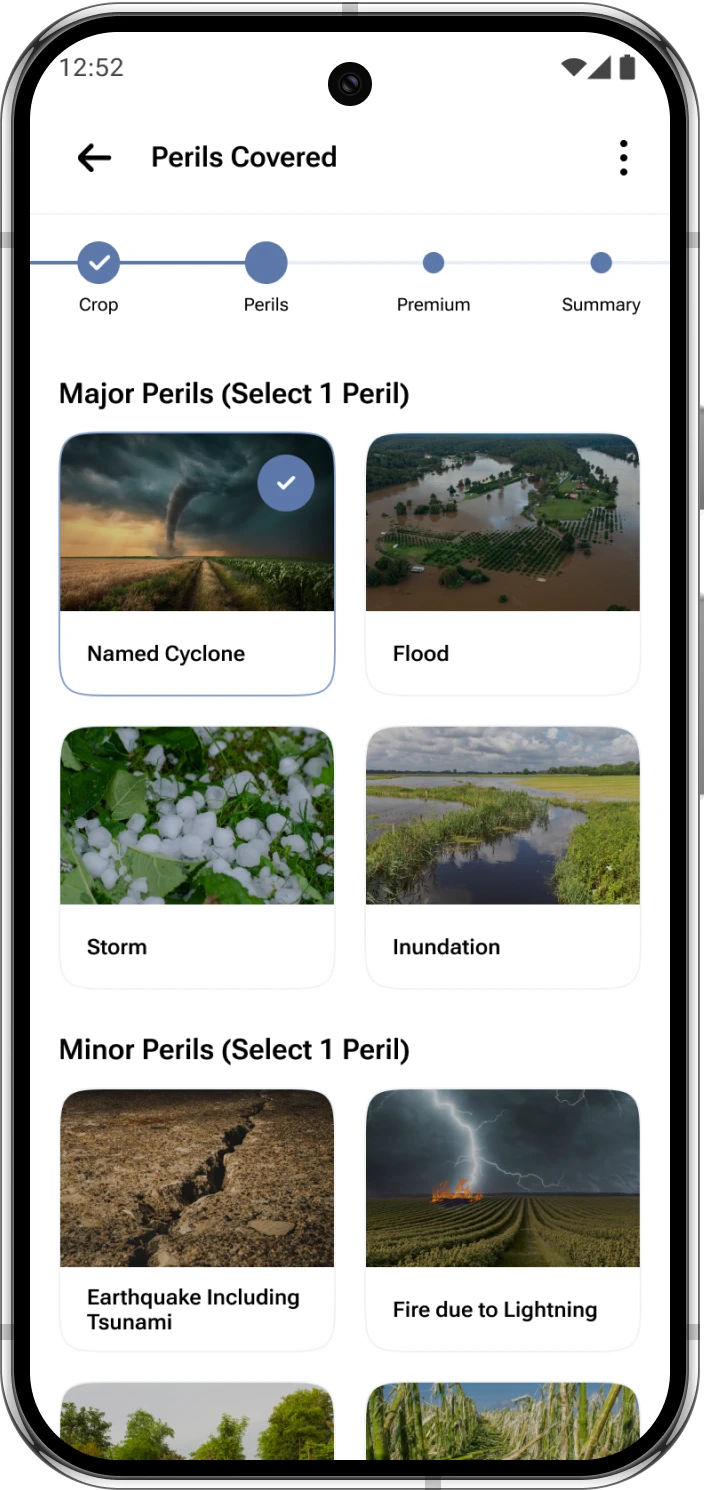

Key Coverage Types:

Yield-based Coverage: This type of coverage protects against significant declines in crop yield due to perils like flood, pests, or disease.

Revenue-based Coverage: This coverage is ideal for protecting your revenue in case of market price fluctuations or yield loss. It ensures that you receive a certain level of income even if crop prices drop.

Comprehensive Coverage: Some policies offer a more extensive form of protection, covering a broad range of risks, from weather-related issues.

2. Research Crop Insurance Providers

Different providers offer varying terms, premiums, and levels of support. It’s crucial to research providers in your area and assess their reputation for handling claims efficiently. Look for a company that understands the agricultural sector and has experience with crop insurance policies.

Questions to Ask When Evaluating Providers:

- How long have they been providing crop insurance?

- Do they have a good reputation among local farmers?

- What is their claims settlement process like?

- Are they quick to respond to claims, or are there long waiting periods?

3. Compare Policy Options and Costs

Comparing policy options is essential to find the best crop insurance policy for your needs. Look beyond the premium cost to understand what you’re actually getting. Often, cheaper policies might have limited coverage, which may not be beneficial in case of significant crop loss.

Key Aspects to Compare:

Premiums: Compare premium rates from multiple providers. However, a lower premium isn’t always the best choice if it comes with reduced coverage.

Deductibles: Some policies have higher deductibles, meaning you’ll have to bear more of the initial cost of crop loss. Lower deductible plans often have higher premiums but may provide better coverage in case of disasters.

Payout Limits: Look for any limitations on the payout amount. Some policies might cap their payouts, which could leave you underinsured during large-scale losses.

4. Assess Government-Backed Crop Insurance Schemes

The government offers nationwide crop insurance schemes at subsidized rates, making it an affordable option for many farmers. In India, the Pradhan Mantri Fasal Bima Yojana (PMFBY) offers comprehensive coverage with premium rates subsidized by the government. These schemes provide great value and often cover a wide range of risks.

Advantages of Government Schemes:

- Lower premium rates due to subsidies

- Comprehensive coverage against major perils

- Often mandatory participation by insurance providers, ensuring availability of support across regions

Considerations:

While these schemes are highly affordable, they may have limitations on the types of crops covered and may sometimes have longer claim processing times. Check whether your crop is eligible under these schemes and evaluate the coverage limits.

5. Evaluate Add-On Coverage Options

Many insurance providers offer add-ons to enhance the protection of standard policies. These add-ons might include coverage for specific risks that are prevalent in your region.

Popular Add-On Options:

Localized Weather Risk Add-Ons: In areas prone to specific climate risks (e.g., hailstorms, cyclone), adding specific coverage can be beneficial.

Pest and Disease Add-Ons: If your crops are vulnerable to certain pests or diseases, some insurers offer additional coverage against these threats.

Income Stability Add-Ons: This add-on protects against unexpected drops in crop prices, offering revenue stability in volatile markets.

Should You Opt for Add-Ons?

Add-ons come at an extra cost, so assess whether the additional risk warrants the extra expense. If the risks are substantial, such as hail damage in certain regions, it may be worthwhile.

6. Understand the Claims Process

A good crop insurance policy should come with a hassle-free claims process. It’s essential to understand how the claims process works and how long it will take to receive a payout. Providers who have a streamlined process, transparent guidelines, and a reputation for timely settlements are more reliable choices.

Steps to Review:

- Check the requirements for filing a claim and required documentation.

- Understand the timeline from claim filing to settlement.

- Verify the communication process between you and the insurer.

Tip: It may be beneficial to speak with other farmers who have filed claims with the insurer to get a firsthand account of the process.

7. Consider Policy Flexibility

Flexibility in policy terms is another critical factor. Some crop insurance policies are adjustable and allow you to change coverage levels or add/remove add-ons over time. This can be helpful if you need to adapt your coverage to changing risks or new types of crops.

Benefits of Flexible Policies:

- They can adapt to your evolving needs.

- They allow you to scale up or scale down based on financial capability and risk levels.

8. Seek Professional Advice

Choosing the best crop insurance policy can be a complex process. Consulting with an insurance advisor or agribusiness expert can help you make an informed decision based on your unique circumstances. They can offer insights into policy nuances, assist with comparisons, and help you understand technical terms.

Conclusion

Selecting the right crop insurance policy is a critical decision that can safeguard your farming business against the unpredictability of weather, pests, and market fluctuations. By understanding your risks, comparing options, exploring government schemes, considering add-ons, and evaluating the claims process, you’ll be well-equipped to choose a policy that meets your needs. Remember, the best crop insurance policy is the one that provides comprehensive protection, is affordable, and offers peace of mind in challenging times.