How Crop Insurance for Small Farmers Safeguards Livelihoods in India

Crop insurance for small farmers has become essential as weather changes, pest attacks and rising input costs make farming unpredictable. Small and marginal farmers are most affected because even a single crop loss can disturb their entire income. This guide explains why crop insurance is important for small farmers, how it protects livelihoods and what benefits farmers receive when their crops are insured.

This blog explores how crop insurance can for small farmers’ livelihoods, highlighting the benefits of crop insurance and how it contributes to a secure and prosperous farming future.

- Buy in easy steps

- Premium Starts at INR 499

- Protect 100+ Crops

- Quick & Easy Claims

The Challenges Faced by Small Farmers

Unpredictable Weather:

- Climate change causes droughts, floods, and storms.

- Pests & Diseases: Infestations can destroy entire fields.

- Market Fluctuations: Sudden price drops affect farmer income.

- High Costs: Seeds, fertilisers, and pesticides are expensive.

These challenges highlight the vulnerability of small farmers and the critical need for safeguards like crop insurance to protect their livelihoods.

Also Read: How to Choose the Right Crop Insurance Policy

Small farmers depend heavily on a single cropping cycle for income. When weather events like drought or heavy rain destroy crops, they struggle to repay loans or buy seeds for the next season. Crop insurance reduces this pressure by offering compensation during crop loss and helping farmers continue farming with confidence.

Why Crop Insurance for Small Farmers?

Crop insurance protects farmers from crop loss due to disasters, pests, or disease. It offers financial support and peace of mind during tough seasons. By paying a nominal premium, farmers can ensure that they receive compensation if their crops are damaged. This helps them recover from losses and sustain their livelihoods. Ultimately, crop insurance offers peace of mind, enabling farmers to continue their operations even in the face of adversity, ensuring long-term agricultural stability and growth. Crop Insurance Can Safeguard Small Farmers’ Livelihoods

Why Crop Insurance for Small Farmers Is Important

How Crop Insurance Protects the Livelihoods of Marginal Farmers

1. Financial Stability in Tough Times

2. Encourages Risk-Taking

Knowing their crops are insured, farmers are more likely to invest in high-yield seeds, advanced equipment, or modern agricultural practices. Crop insurance reduces the fear of financial loss, encouraging small farmers to take calculated risks that can increase productivity and income.

3. Protection Against Climate Risks

With changing climate conditions, unpredictable rainfall and extreme weather events have become more frequent. Crop insurance covers losses from natural calamities, giving small farmers the confidence to keep farming despite environmental uncertainties and ensuring their livelihood.

4. Promotes Financial Inclusion

Crop insurance programs, including government-supported schemes, often cover small and marginal farmers who are typically excluded from formal financial systems. By being a part of the crop insurance schemes, farmers gain access to institutional support and financial aid during crises.

5. Reduces Dependency on Informal Credit

In absence of a crop insurance, small farmers often rely on high-interest loans from informal sources to cope with crop failures. Crop insurance reduces this dependency by providing timely compensation, protecting farmers from exploitative lenders.

6. Boosts Rural Economy

7. Crop insurance also improves long term farm planning

Crop Insurance Benefits for Small Farmers in India

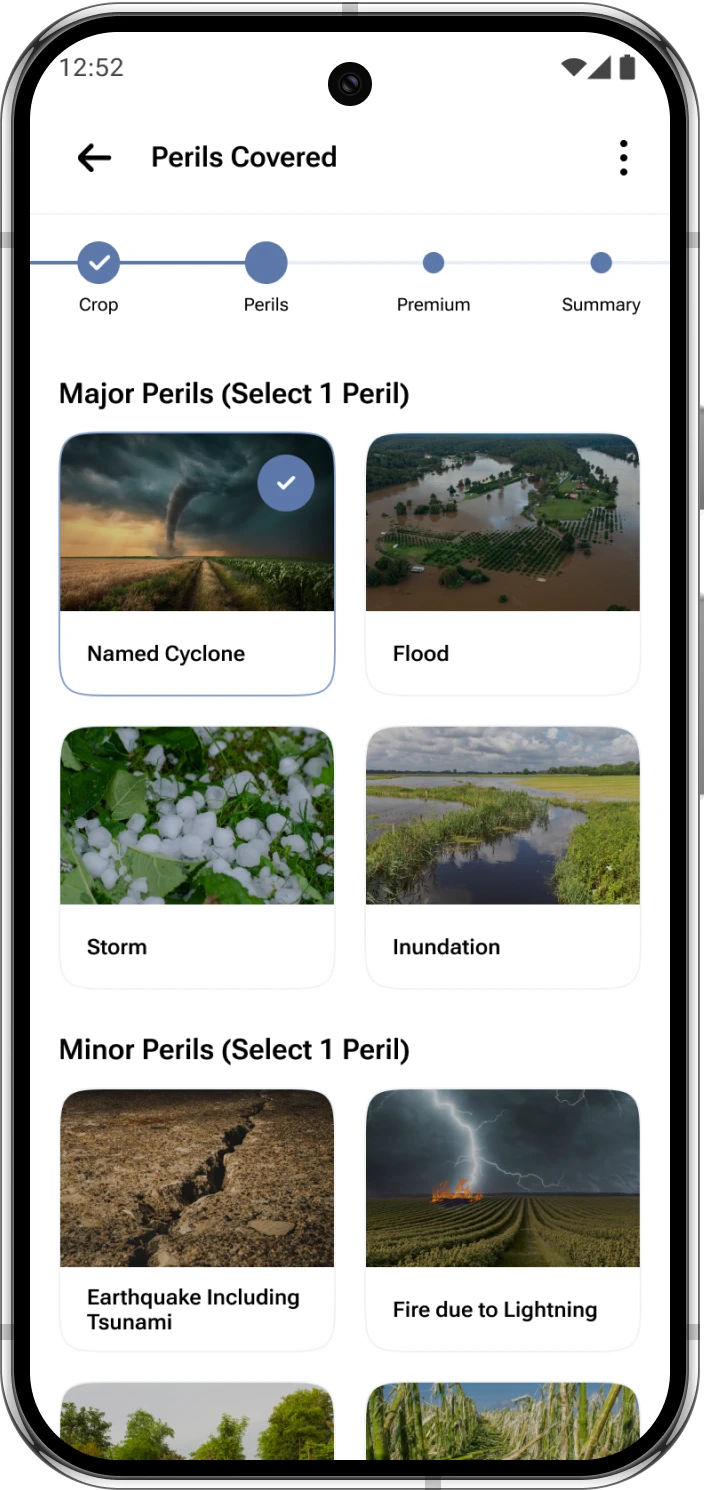

- Comprehensive crop insurance covers a wide range of risks, including natural disasters like floods, cyclones, earthquakes, etc., pests, and diseases. It provides all-around protection for farmers, ensuring they are financially secure in any scenario.

- Affordable premiums of government-backed crop insurance schemes, such as the Pradhan Mantri Fasal Bima Yojana (PMFBY) offers coverage at subsidised premium rates. This makes crop insurance affordable for everyone.

- Quick claim settlements under crop insurance policies ensure that farmers receive financial assistance when they need it the most. This timely support helps them recover from losses and prepare for the next crop cycle.

- Customised crop insurance policies can be tailored to suit specific crops, regions, and farming practices, ensuring that farmers get coverage that meets their unique needs.

Government Schemes Supporting Crop Insurance

The Indian government plays a crucial role in promoting crop insurance to protect small farmers. Some key initiatives include:

Pradhan Mantri Fasal Bima Yojana (PMFBY): Offers full coverage for notified crops. Farmers pay subsidised premiums; the government covers the rest.

Restructured Weather-Based Crop Insurance Scheme (RWBCIS): Compensates farmers for weather-related losses like unseasonal rain or temperature shifts.

Read also:How to Choose the Right Crop Insurance Policy

These schemes ensure that small farmers have access to affordable and effective crop insurance solutions.

Kshema General Insurance: Supporting Small Farmers

At Kshema General Insurance, we understand the critical role that small farmers play in India’s agricultural sector.

Kshema offers crop insurance plans that are:

- Comprehensive and customised

- Affordable for small farmers

- Easy to buy and claim

- Supported by expert customer service

Partnering with government schemes like PMFBY as well as offering our own products- Sukriti and Prakriti, we aim to empower small farmers and ensure that they have the financial security to face challenges confidently.

By choosing a crop insurance for small farmers from Kshema, farmers gain access to:

- Reliable risk protection

- Easy purchase and claims processes

- Customer support from a team that truly understands their needs

Crop insurance for small farmers provides reliable protection against unexpected weather, pests and crop failure. It helps farmers stay financially stable, continue farming and secure their livelihoods. With Kshema’s affordable and farmer friendly insurance plans, small farmers can protect their income and grow with confidence. Explore Kshema’s crop insurance options to safeguard your next season.

Frequently Asked Questions for Crop Insurance for Small Farmers

1. Why is crop insurance important for small farmers?

2. What are the benefits of crop insurance for small farmers?

3. Which crop insurance options are available in India?

4. How can small farmers buy crop insurance?

5. Does crop insurance support farmer income stability?

Disclaimer:

We do not assume any liability for any actions undertaken based on the information provided here. The information gathered from various sources and are displayed here for general guidance and does not constitute any professional advice or warranty of any kind.