For farmers in India, a crop insurance claim is more than a formality—it is essential protection against unpredictable weather, pest attacks and natural disasters. A correctly filing claims helps farmers recover losses quickly, but even small errors can lead to denial or reduced compensation. Missed reporting deadlines, incorrect documents and unverified enrolment are some of the most common PMFBY claim mistakes.

This blog explains the top five crop insurance claim errors farmers should avoid and offers simple fasal bima tips to ensure smooth, timely compensation.

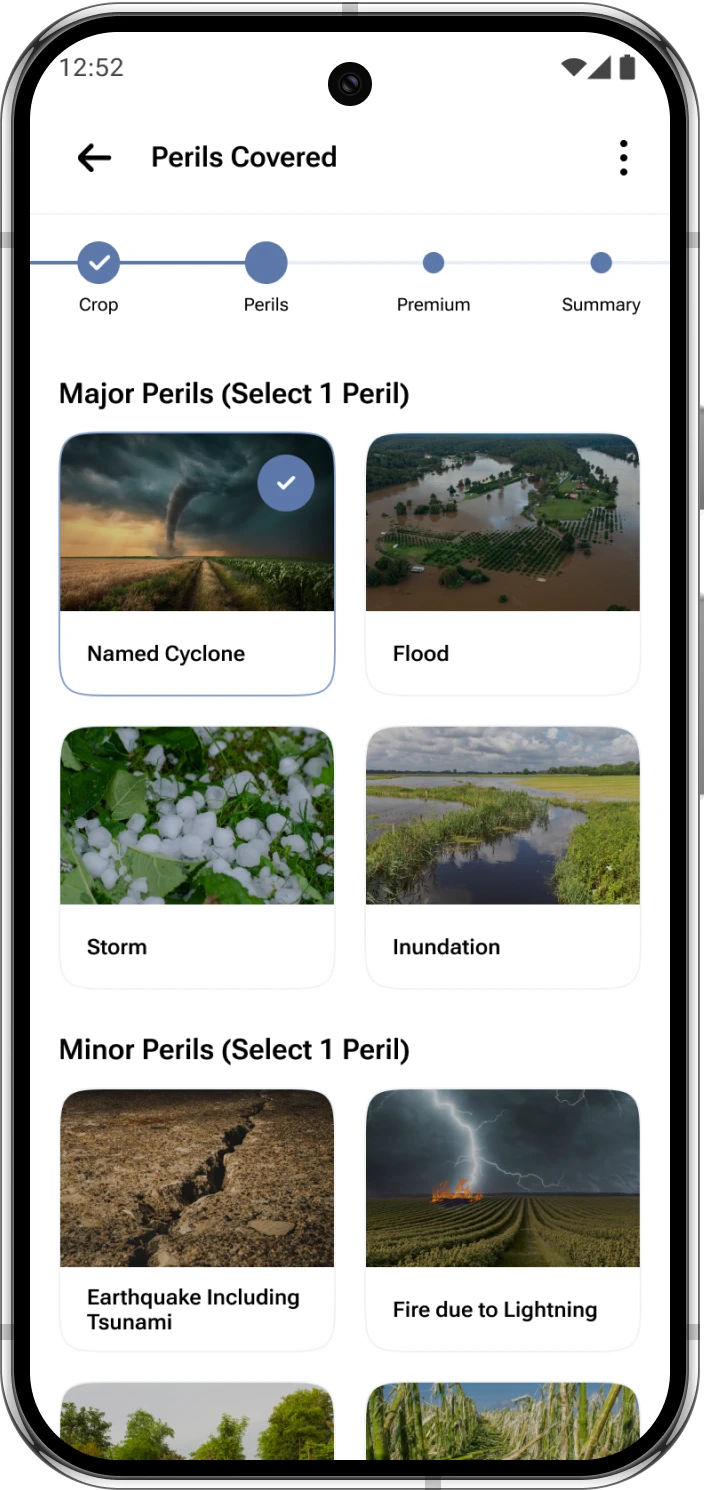

- Buy in easy steps

- Premium Starts at INR 499

- Protect 100+ Crops

- Quick & Easy Claims

Mistake 1: Missing the Reporting Deadline

One of the biggest reasons crop insurance claims get rejected is late reporting. Farmers must inform authorities immediately after crop damage occurs. Many wait until harvest, but this is not allowed. Insurance companies and government agencies use fixed timelines to verify losses on the field. Delayed reporting leads to PMFBY claim errors and rejected claims.

Fasal bima tips: Always keep track of reporting crop insurance deadlines in your district. If crops suffer damage, inform your bank, CSC or insurance company right away so your claim remains valid.

Mistake 2: Incomplete or Incorrect Documentation

Submitting incorrect or incomplete papers is another common reason for crop insurance claim delays. Slight mismatches—such as different spellings in Aadhaar and bank records, old land records or incorrect survey numbers—can stop claims from being processed. Under PMFBY, documentation is crucial for verification.

Fasal bima tips: Double-check every document before submission. Ensure Aadhaar, bank details and land records match. Keep copies of all papers to support your crop insurance claim.

Mistake 3: Not Verifying PMFBY Enrolment Status

Many farmers assume they are automatically enrolled under PMFBY if they have taken a crop loan. However, enrolment is not always guaranteed. Sometimes banks fail to upload data or premiums do not get processed. Filing a crop insurance claim without confirming enrolment makes the claim invalid.

Fasal bima tips: Before sowing, visit your bank or CSC to confirm your enrolment. Request an acknowledgement slip and store it safely.

Mistake 4: Ignoring Local Guidelines and Notifications

Each state and district may issue specific instructions regarding crop insurance claims. Farmers who ignore these local guidelines often face problems.

- For example, some regions require farmers to notify village-level officers in addition to banks.

- Failure to follow these rules results in PMFBY claim errors that delay compensation.

- Local notifications also provide information about survey schedules and verification visits.

Fasal bima tips: Stay updated with announcements from your district agriculture office. Attend farmer meetings and check notice boards at banks or CSCs. Following local rules ensures your crop insurance claim is processed without hurdles.

Mistake 5: Lack of Evidence of Crop Loss

Perhaps the most critical mistake is failing to provide evidence of crop damage. A crop insurance claim must be backed by proof, whether through photographs or surveyor reports.

- Farmers often rely solely on verbal reports, which are insufficient.

- Without evidence for localised calamities, claims are categorised as PMFBY claim errors and rejected.

- Proper documentation helps authorities assess the extent of loss accurately.

Fasal bima tips: Take clear photographs of damaged fields, keep records of rainfall or pest attacks, and cooperate with surveyors during inspections. Evidence strengthens your case and ensures fair compensation under your crop insurance claim.

How to Avoid These Crop Insurance Claim Mistakes

Filing a crop insurance claim doesn’t have to be complicated. By avoiding these five mistakes, farmers can ensure smoother processing and quicker payouts.

- Report losses promptly to avoid missing deadlines.

- Check documents carefully to prevent errors.

- Verify enrolment status before sowing.

- Follow local guidelines issued by authorities.

- Provide evidence to support your claim.

These steps not only reduce PMFBY claim errors but also increase the chances of receiving timely compensation. Practical fasal bima tips like keeping records, staying informed, and cooperating with officials can make the process far less stressful.

A crop insurance claim is more than just paperwork. It is a shield for farmers to protect their incomes from unpredictable weather and market conditions. By learning from common mistakes and applying practical fasal bima tips, farmers can protect their livelihoods and secure their future.

Why Avoiding PMFBY Claim Errors Matters

The PMFBY scheme has been designed to support farmers, during difficult seasons, but its success depends on timely and accurate claims. Avoiding common crop insurance claim mistakes ensures faster verification, quicker payouts and greater financial security for farming households.

For official guidelines and claim process details, visit the Pradhan Mantri Fasal Bima Yojana Portal.

Conclusion

A successful crop insurance claim relies on timely reporting, correct documentation and awareness of PMFBY guidelines. By avoiding the five common mistakes, farmers can protect themselves from delays and claim rejections. Simple fasal bima tips—such as keeping evidence, verifying enrolment and following local instructions—ensure smooth claim processing and fair compensation. Crop insurance provides vital support during uncertain conditions, and understanding the claim process helps safeguard farmer income and livelihoods.

1. What is a crop insurance claim?

A crop insurance claim is a request for compensation when insured crops are damaged due to risks like drought, flood, pests or storms.

2. Why do crop insurance claims get rejected?

Claims are rejected due to late reporting, incorrect documents, missing evidence or unverified PMFBY enrolment.

3. How can farmers avoid mistakes when filing crop insurance claims?

Report losses early, verify enrolment, keep documents accurate and collect strong evidence like photos.

4. What documents are needed for a crop insurance claim?

Updated land records, Aadhaar, bank account details, proof of sowing and crop loss evidence.