Peril-Based Crop Insurance in India: Smart Protection for Your Rabi Crops

Introduction

Farmers face multiple risks during the Rabi season, from droughts to pest attacks. Peril-based crop insurance offers targeted protection against these threats, ensuring financial stability. This article explains how peril-based policies work, their benefits, and why they are crucial for Indian farmers.

- Buy in easy steps

- Premium Starts at INR 499

- Protect 100+ Crops

- Quick & Easy Claims

Traditional crop insurance schemes offer broad protection, but many farmers are now leaning towards peril-based crop insurance, which is more targeted and flexible, aligning better with their specific needs.

This blog explores what peril-based crop insurance entails, how it differs from other crop insurance coverage types, and why it’s gaining popularity among farmers.

Quick Answer:

What Is Peril-Based Crop Insurance and How Does It Work?

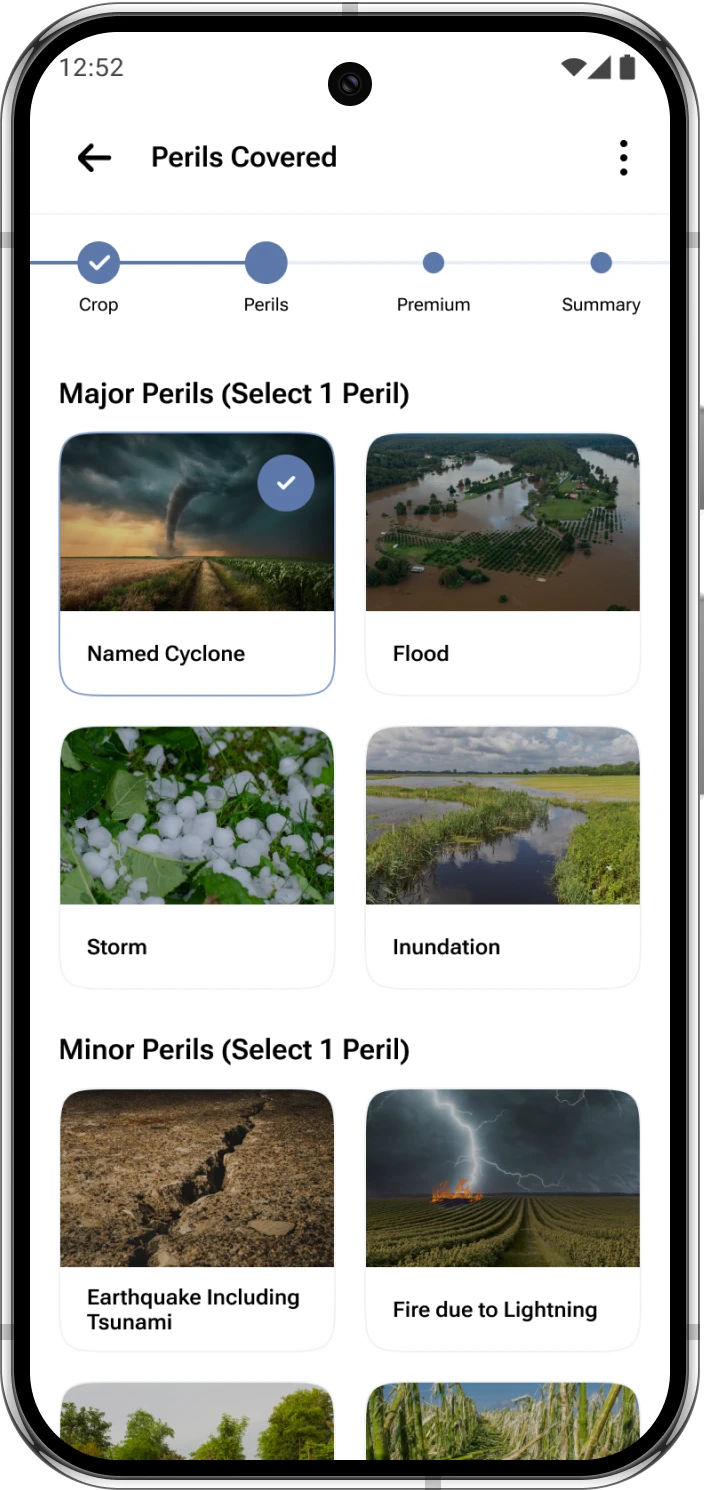

Peril-based crop insurance is a type of crop insurance that provides financial protection against specific risks or “perils” that may damage or destroy crops. These perils can include natural calamities like floods, hailstorms, earthquakes, or animal attacks on crops. Unlike broader insurance schemes, peril-based insurance allows farmers to choose coverage based on the most probable threats to their region or crop type.

Why Should Rabi Farmers Choose Peril-Based Insurance?

Rabi crops face unique risks such as frost, hailstorms, and unseasonal rain during critical growth stages. Peril-based insurance allows farmers to select coverage for these specific threats, making it cost-effective and highly relevant. This targeted approach ensures better financial protection without paying for unnecessary coverage.

What are the different types of crop insurance in India?

1. Weather Index Insurance

Based on weather data (e.g., rainfall, temperature) rather than actual crop damage. Quick payouts but may not reflect actual losses on the ground. Suitable for regions with reliable weather monitoring infrastructure.

2. Yield-Based Insurance

Provides compensation when actual crop yield falls below the threshold yield due to insured risks. Based on historical yield data and current season performance. Pradhan Mantri Fasal Bima Yojana (PPMFBY) is a prominent example, offering yield-based coverage for a wide range of high-yield Rabi crops in India with government-subsidised premiums coverage for a wide range of crops with government-subsidised premiums.

3. Peril-Based Insurance

Covers only the specific peril(s) listed in the policy. Offers targeted protection and lower premiums. Ideal for farmers who understand their local risk profile. Kshema Sukriti and Kshema Prakriti are examples of this category, offering a focused alternative to yield-based and weather index schemes.

What are the benefits of peril-based crop insurance for farmers?

1. Customised Coverage

One of the biggest advantages of peril-based crop insurance is its flexibility. Farmers can tailor their coverage to match the actual risks they face. For example: A farmer in Assam may prioritise flood protection. A horticulturist in Himachal Pradesh may choose hailstorm coverage. This targeted approach ensures that farmers aren’t paying for protection they don’t need, making it more focussed and cost-effective.

2. Faster Claims Processing

With fewer variables to assess, claims under peril-based insurance are often processed more quickly. This is especially important for the Rabi season, when timely insurance claimed settlement can help farmers reinvest in the next Kharif crop cycle.

This is especially important for the Rabi season, when timely insurance claim settlement can help farmers reinvest in the next Kharif crop cycle using efficient irrigation methods for Rabi crops.

3. Better Risk Management

By choosing coverage based on local climate and historical data, farmers can manage their risks more strategically. This proactive approach helps reduce financial stress and improves long-term farm sustainability.Improves long-term farm sustainability through crop protection strategies for Rabi.

How do farmers file claims under peril-based crop insurance?

The process is relatively straightforward:

- Risk Assessment: Farmers identify the most likely threats to their crops based on geography, crop type, weather pattern, and historical data.

- Policy Selection: They choose a policy that covers one or more specific perils.

- Premium Payment: Premiums are calculated based on the risk level and coverage amount.

- Monitoring: Insurance providers monitor weather conditions.

- Claim Filing: If the insured peril occurs, farmers file a claim with supporting evidence.How Peril-Based Insurance Works farmers file a claim with supporting evidence through a digital claim filing process

- Payout: After verification, claim amount is disbursed to help cover losses.

Many insurers like Kshema General Insurance offer digital platforms for policy management and claim tracking, making the process more transparent and farmer friendly.

Kshema’s Peril-Based Crop Insurance Solutions: Kshema Sukriti & Kshema Prakriti

Kshema General Insurance offers two flagship crop insurance products — Kshema Sukriti and Kshema Prakriti — designed to meet the diverse needs of Indian farmers.

Kshema Sukriti

Kshema Sukriti offers customizable insurance for frost and hail damage, allowing farmers to select only the perils most relevant to their region.This flexibility makes Sukriti ideal for farmers who understand their local agro-climatic conditions and want customisable peril-based crop insurance without paying for additional coverage.

Kshema Prakriti

Kshema Prakriti, on the other hand, is a comprehensive crop insurance solution that covers crops against all those 8 perils, including animal attacks. It’s designed for farmers who prefer all-round protection and peace of mind throughout the crop cycle.

Both products reflect Kshema’s commitment to empowering farmers with affordable and region-specific insurance options that align with modern agricultural challenges.

Government Support and Schemes

The Government of India supports crop insurance through government schemes like:

- Pradhan Mantri Fasal Bima Yojana (PMFBY): Offers yield-based coverage with subsidised premiums. Learn more about coverage, eligibility, and premium subsidies on the official PMFBY portal.

- Restructured Weather-Based Crop Insurance Scheme (RWBCIS): Focuses on weather index insurance for specific crops and regions.

Considerations for Peril-Based Crop Insurance

While peril-based crop insurance offers many benefits, the following should be kept in mind:

- Limited Coverage: It may not protect against all possible risks.

- Awareness Gap: Many farmers may be unaware of the options available or may lack guidance on customising their policies.

- Data Dependency: Accurate risk assessment requires reliable historical and meteorological data, which may not be available in all regions.

To overcome these challenges, insurers and agricultural departments must invest in farmer awareness drives, insurance education, data infrastructure, and mobile-based advisory services.

Final Thoughts

In today’s uncertain farming environment, crop insurance is not just a safety net—it’s a but a strategic tool. Peril-based crop insurance offers farmers the ability to protect their livelihoods against the most relevant threats, without the burden of high premiums or complex policies.

By understanding the different crop insurance coverage types and choosing wisely, farmers can safeguard their investments, stabilise their income and build a more secure future. Whether you’re growing wheat in Punjab or mustard in Rajasthan, smart insurance choices can make all the difference.

Frequently Asked Questions About Peril-Based Crop Insurance for Indian Farmers

1. What is peril-based crop insurance?

It’s a type of insurance that covers specific risks like floods, hailstorms, or animal attacks, allowing farmers to choose coverage based on local threats.

2. How does peril-based insurance differ from comprehensive insurance?

Peril-based insurance targets specific threats, while comprehensive covers all risks.