Crop Insurance in India: 7 Must-Know Facts for Farmers in 2025

- Buy in easy steps

- Premium Starts at INR 499

- Protect 100+ Crops

- Quick & Easy Claims

Crop insurance is a crucial safety net for farmers in India, helping to protect them from financial losses due to crop failures or damage caused by natural calamities. Over the past decade, India’s crop insurance system has undergone significant improvements. Despite these advancements, concerns remain about the efficacy and financial sustainability of agriculture insurance due to less awareness in the domain.

Let’s talk about the current state of crop insurance in India, including its objectives, risk coverage, types, functioning, and benefits. Additionally, let’s assess the role of private insurers like Kshema General Insurance in enhancing the reach and effectiveness of crop insurance in India.

Objective Of Crop Insurance

The primary objectives of crop insurance are:

- Financial Support: Providing financial aid to farmers who suffer crop loss or damage due to unforeseeable events like natural disasters.

- Income Stability: Ensuring income stability for farmers, enabling them to continue their farming activities.

- Financial Sustainability: Decreasing the dependency on finances/agricultural loans in the agri-sector to promote growth, crop diversification, food security, and protection against production risks.

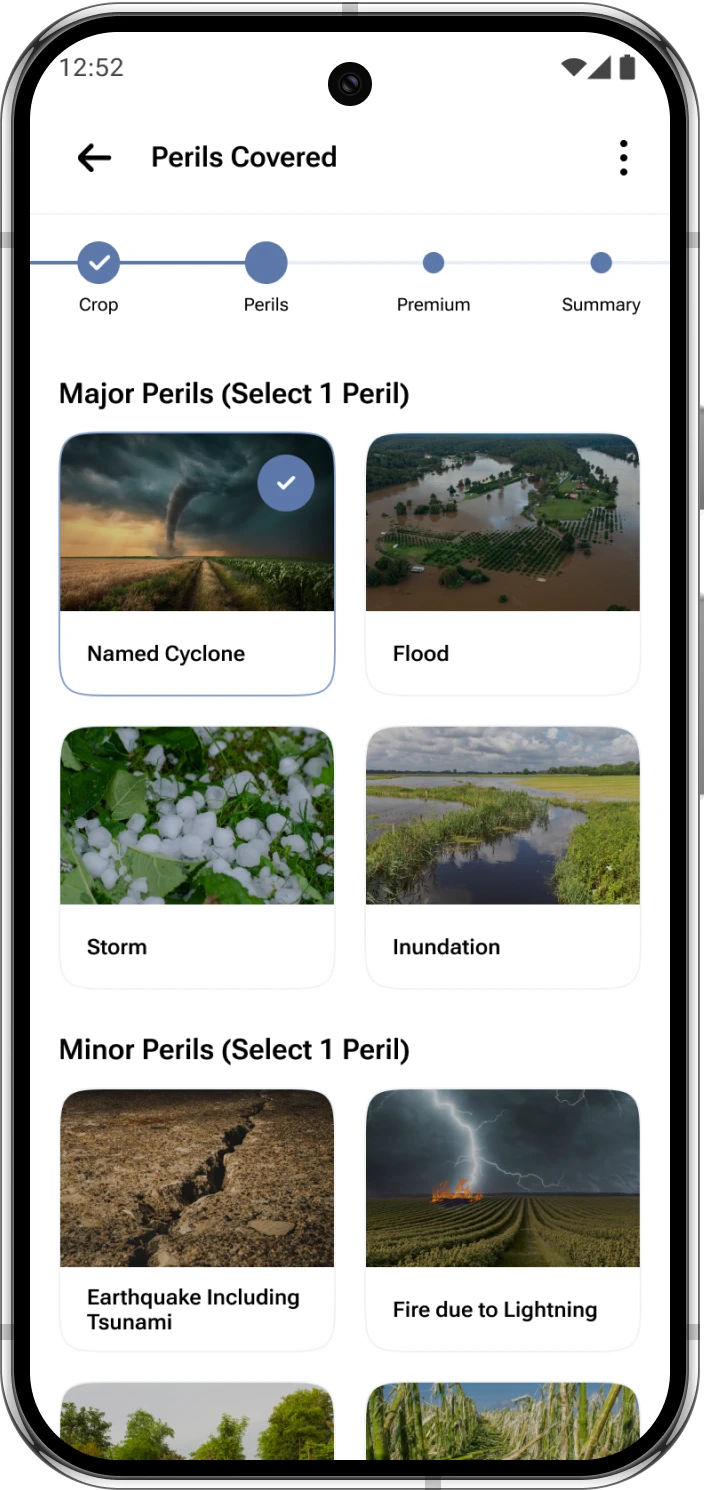

Crop Insurance Risk Coverage

- Reduced Planting/Sowing Risks caused by unfavorable seasonal conditions or inadequate rainfall.

- Standing Crops Damage due to lightning, storms, hailstorms, cyclones, typhoons, tempests, hurricanes, tornadoes, pests, diseases, flooding, inundation, landslides, etc.

- Post-Harvest Losses: Coverage for losses occurring within two weeks after harvest.

- Localized Hazards like landslides and hailstorms that occurred in a particular region.

Types Of Crop Insurance

There are three main categories of crop insurance:

- Multiple Peril Crop Insurance: Provides financial protection against weather-related losses such as flooding and drought.

- Real Production History:Covers damages caused by insects, wind, hail and more.

- Crop Revenue Coverage: Based on both crop yield and the total revenue from the yield, including coverage for lower yields and discrepancies between estimated and actual yields. It also compensates for price drops in crops.

How does Crop Insurance Function?

- Policy Selection: Choosing a policy based on risk assessment and comparing various policies and providers.

- Insured Amount: Determined by factors such as crop type, location, past yield information, and the region’s disaster history, the insured amount with respect to the premium paid should be a major determining factor while selecting an insurance.

- Claim Process: Claims are processed based on post-harvest, localized, mid-season, and widespread tragedies, with payouts considering yield per hectare or weather conditions. The preferred claim type should be considered before buying any crop insurance policy.

Eligibility Criteria

- Farmers: Farmers, including sharecroppers and tenant farmers, are eligible for insurance for farmera as long as they are cultivating the designated crops in the region.

- Non-Loanee Farmers: By presenting land documentation, non-loanee farmers can also avail insurance benefits.

Time Taken to Settle Claims

Benefits of Crop Insurance

These farm protection plans offer several benefits

- Financial Support:Covers crop loss and damage from unforeseen disasters.

- Tax Exemption:Premiums paid for farmer insurance policies are tax-exempt.

- Peace of Mind: Farmers can avoid high-interest loans from private lenders in case of loss.

- Advanced Techniques: Encourages the use of modern agricultural techniques to boost income.

- Economic Boost: Enables farmers to repay loans with insurance payouts, enhancing the national economy.

According to the IRDAI and FAO, crop insurance is vital for food security and climate resilience in developing economies.

Takeaway

India’s agriculture insurance landscape has evolved rapidly, but challenges remain in awareness, affordability, and access. Kshema’s Sukriti Policy—starting at ₹499/acre—bridges this gap with customizable coverage and fast claims. Continuous assessment and improvement are essential to provide effective, affordable, and sustainable insurance solutions.

Kshema General Insurance‘s commitment to affordable insurance helps ensure that more farmers can protect their livelihoods and continue contributing to the nation’s food security and economic growth. Our Sukriti Policy starts at just Rs 499/acre and provides customisable insurance solution.

Ready to protect your crops this season? Explore Kshema Crop insurance plans and choose the coverage that fits your farm.

FAQs from the Crop Insurance Guide

1. What is crop insurance and why is it important?

2. What types of farmer insurance are available in India?

3.How do I file a claim under Kshema’s crop insurance?

4.What’s the cost of crop insurance for small farmers?

Kshema’s Sukriti Policy starts at ₹499/acre, with flexible coverage options based on crop type, season, and location.