Is Fasal Bima Yojana India’s largest crop insurance scheme?

Farmers today search for one clear answer: Is Pradhan Mantri Fasal Bima Yojana (PMFBY) India’s largest crop insurance scheme? With rising weather risks, pest attacks and sudden crop loss events, understanding PMFBY’s coverage, benefits and claim process has become essential. This guide explains PMFBY benefits, premium rates, coverage percentages, why it is considered India’s biggest crop insurance scheme and how farmers can easily enrol through digital platforms. A clear, simple, farmer-friendly explanation for 2026.

Want to know eligibility, covered crops and official scheme details? Visit Pradhan Mantri Fasal Bima Yojana (PMFBY) for coverage and registration guidance.

- Buy in easy steps

- Premium Starts at INR 499

- Protect 100+ Crops

- Quick & Easy Claims

Is PMFBY India’s Largest Crop Insurance Scheme?

Yes. PMFBY is widely recognised as one of India’s largest crop insurance schemes in terms of farmer enrolment, premium subsidies and geographical coverage. Millions of farmers benefit every year through government-supported premiums and wide risk coverage across states. This is why most official documents describe PMFBY as India’s flagship crop insurance programme.

PMFBY Coverage: How Many Farmers Benefit?

PMFBY covers a large percentage of India’s agricultural land and farmer families. Every season, a significant number of farmers enrol for the scheme due to low premium rates and government subsidy. The scheme is available across Kharif, Rabi and commercial crops, giving farmers protection from multiple natural and localised risks.

1. Financial Protection Against Crop Losses

One of the most significant fasal bima yojana benefits is the financial safety net it provides when crops fail due to natural calamities. Whether it’s drought, flood, cyclone, or unseasonal rainfall, farmers receive claims for insuring their crops which help them recover and prepare for the next season. This form of crop insurance coverage ensures that a single bad season does not push them into a cycle of debt.

2. Coverage Across All Stages of Crop Cycle

PMFBY is designed to support farmers throughout the entire crop cycle. From pre sowing to postharvest, the scheme covers risks at every stage. This holistic approach is one of the key PMFBY advantages, ensuring farmers are protected even before the seeds are sown or after the crops are harvested. Such comprehensive crop insurance coverage is rarely found in traditional insurance schemes.

3. Affordable Premium Rates

Affordability is central to the scheme’s success. Small farmers often avoid insurance due to high premiums, but PMFBY offers extremely low rates –

- 2% for Kharif crops, 1.5% for Rabi crops, and 5% for commercial crops.

- This affordability is one of the most appreciated fasal bima yojana benefits, making risk protection accessible to farmers at an unprecedented scale.

You can also check premium rates for Kharif and Rabi crops and how the scheme works season-wise.

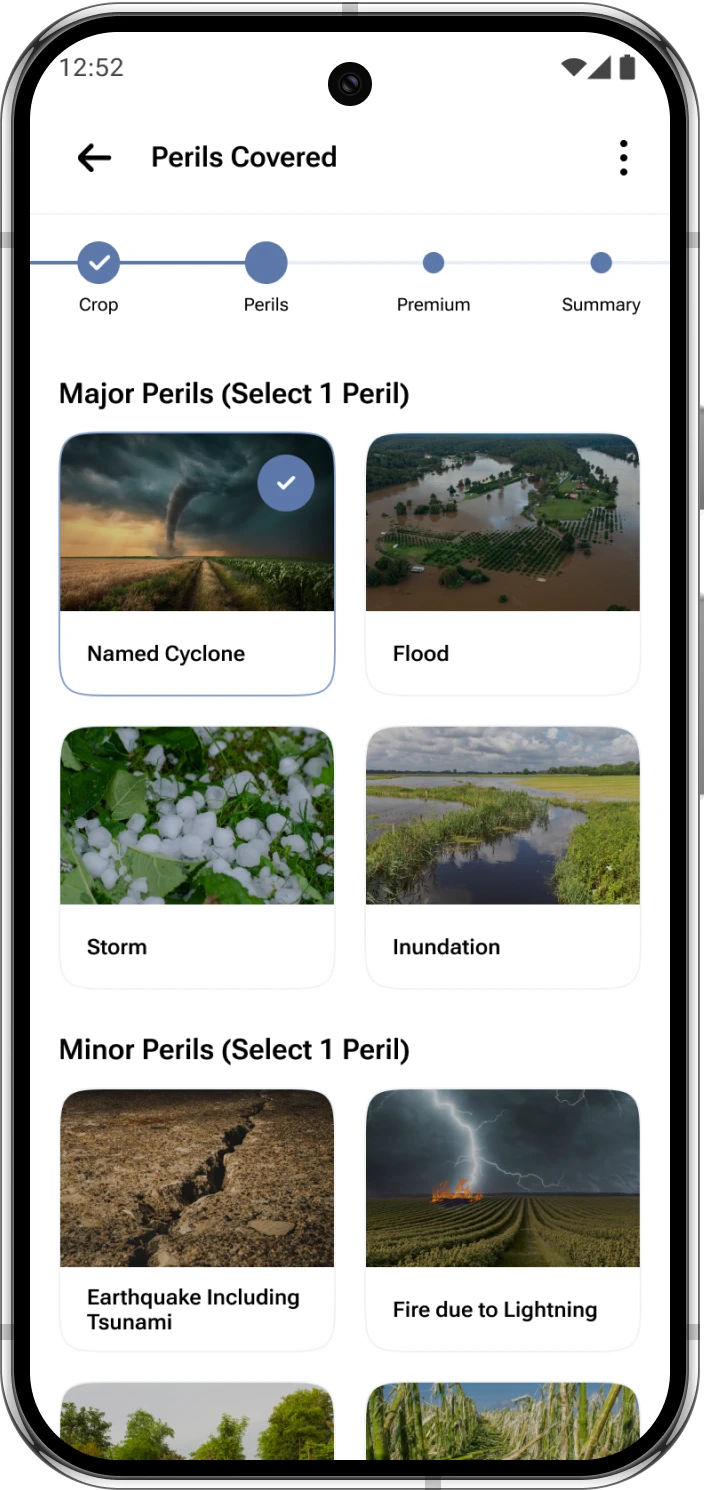

4. Easy Enrolment Through Digital Platforms

Technology has made PMFBY more accessible than ever. Farmers can enrol through online portals, mobile apps, or Common Service Centres. This digital convenience is among the modern PMFBY advantages, reducing paperwork and ensuring transparency. It also helps farmers track their claims and receive updates without relying on middlemen.

If you’re comparing options, explore crop insurance plans on Kshema to find the best cover based on your crop and risks.

5. Timely Claim Settlement

The claim settlement process is simple and designed to work in tandem, with the claim amount directly based on the stage of the crop. A farmer has to intimate the insurance company about the damage within 72 hours of the incident. Loss assessment is mandated to be completed within 15 days after the damage.

The on-account payment would be disbursed by the insurer without waiting for the receipt of final share of Government subsidy as per scheme guidelines. This reduces delays and ensures timely compensation as part of the fasal bima yojana benefits, giving farmers confidence that their losses will be addressed without long waiting periods.

In case of loss, farmers can file a crop insurance claim online through Kshema to start the claim process quickly.

6. Protection Against Localised Calamities

Small farmers are often the worst affected by localised disasters such as hailstorms, landslides, or pest attacks. PMFBY covers these events as well, making it a highly inclusive scheme. This is another reason why crop insurance coverage under PMFBY is considered one of the most farmerfriendly in the world.

New to insurance? Here’s a simple guide on how crop insurance works and how payouts are processed after damage

7. Encourages Adoption of Modern Farming Practices

When farmers know their crops are insured, they are more willing to invest in highquality seeds, fertilisers, and modern farming techniques or sustainable farming. This confidence boost is one of the indirect yet powerful fasal bima yojana benefits. It promotes innovation and productivity, helping farmers increase their income over time and making it an attractive proposition.

8. Reduces Dependence on Informal Credit

Crop failure often forces farmers to borrow money at high interest rates from moneylenders which often pushes them into a debt trap. PMFBY reduces this dependency by offering financial support during tough times. This is one of the most socially impactful PMFBY advantages, helping farmers avoid the cycle of debt and maintain financial stability

9. Supports Long Term Agricultural Sustainability

By reducing financial risks, PMFBY encourages farmers to continue farming even if they have had to endure crop loss for one season because their incomes are protected by insurance. This longterm stability is essential for India’s food security. Among all fasal bima yojana benefits, this one has the widest national impact, ensuring that small farmers remain active contributors to the agricultural economy.

10. Boosts Farmer Confidence and Mental WellBeing

Agriculture is stressful, especially when livelihoods depend on factors beyond human control. PMFBY provides emotional reassurance by guaranteeing support during crises. This psychological relief is one of the most underrated fasal bima yojana benefits, but it plays a crucial role in improving farmers’ quality of life.

Crop Cutting Experiments (CCEs) in PMFBY – Why They Matter

How Farmers Can Use the Kshema App With PMFBY

Conclusion

PMFBY is one of India’s largest and most impactful crop insurance schemes, protecting farmers from major natural and localised risks. With affordable premiums, wide coverage and a simple claim settlement system, the scheme gives farmers financial stability even during difficult seasons. Understanding PMFBY’s coverage, key facts and benefits helps farmers make more informed decisions. For additional protection, weather alerts and faster claim filing, farmers can use the Kshema App to safeguard their fields and income.

If you want a broader view beyond PMFBY, read Top 10 benefits of crop insurance for farmers to compare protection advantages.

As climate change continues to challenge traditional farming, schemes like PMFBY offer hope, stability, and resilience. For small farmers striving to build a secure future, the Fasal Bima Yojana is not just an insurance scheme—it is a lifeline.

Official source:

For the latest PMFBY rules, enrolment updates and scheme documents, visit the PMFBY Official Portal.