Rabi Season in India: Crops, Timeline, and Insurance Benefits

- Buy in easy steps

- Premium Starts at INR 499

- Protect 100+ Crops

- Quick & Easy Claims

Key Takeaways:

- Rabi crop insurance protects winter-season crops

- Covers weather, pest and disease risks

- PMFBY provides affordable government-backed coverage

What Is the Rabi Season?

| Crop | Sowing Time | Harvesting Time | Notes |

|---|---|---|---|

| Wheat | Oct–Nov | Mar–Apr | Main Rabi crop; sensitive to frost at flowering |

| Mustard | Oct–Nov | Feb–Mar | Requires cool climate; frost can reduce yield |

| Gram (Chickpea) | Oct–Nov | Feb–Mar | Low water requirement; commonly grown in dry areas |

| Barley | Oct–Nov | Mar–Apr | Cold‑tolerant; suitable for harsh winter regions |

| Peas | Oct–Nov | Feb–Mar | Early‑maturing crop; sensitive to high temperatures |

| Oats | Oct–Nov | Feb–Mar | Used for fodder and grain; grows well in cool weather |

Key Rabi Season Risks (2025):

- Frost & cold waves

- Hailstorms

- Unseasonal rain during flowering

- Pest attacks (aphids, pod borers)

- Rising input costs

As the Monsoon Retreats: Rabi Season Begins

Farmers across India have already started preparing for the Rabi season, the winter agricultural cycle that begins with sowing around October and culminates in harvesting by spring in March or April. Unlike the Kharif season, which relies heavily on rainfall, Rabi crops thrive on residual soil moisture and controlled irrigation. Wheat, barley, mustard, peas, and gram are among the most commonly cultivated Rabi crops.

The shorter of the two crop seasons gives farmers another opportunity to ensure food security for the country and income security for their families.

Challenges Farmers Face During Rabi

Even with favourable weather and diligent farming practices, the Rabi season is not without its risks. Unseasonal rains, hailstorms, floods, pest attacks, and fluctuating market prices can all threaten a farmer’s hard-earned yield. This is where proactive planning, smart technology, and robust crop insurance policies come into play.

Climate change has made the Rabi season more unpredictable, with sudden cold waves, frost, and hailstorms increasingly affecting crops at critical stages.

Understanding the Rabi Season

The Rabi season is often considered more stable than the Kharif season due to its reliance on irrigation rather than monsoon rains. Yet, this stability can be deceptive. Climate change has led to increased unpredictability in weather patterns, with sudden cold waves or hailstorms damaging crops at critical growth stages. Moreover, input costs—such as seeds, fertilisers, and labour—continue to rise, making it essential for farmers to safeguard their investments.

To truly reap the benefits of the Rabi season, farmers must adopt a holistic approach that includes timely sowing, efficient irrigation, pest management, and most importantly, financial protection through crop insurance.

Despite being irrigation‑driven, the Rabi season is vulnerable to rising input costs and shifting weather cycles, making crop insurance essential for risk management.

Kshema: Your Farming Companion

In today’s digital age, technology is transforming agriculture in unprecedented ways.

The Kshema app is one such innovation designed to empower farmers with tools and insights that make farming smarter, safer, and more profitable.

Whether you’re a smallholder or a large-scale cultivator, the Kshema app offers crop insurance policies that suit your region and crop type. Not just that, it uses advanced satellite-based technology to monitor crops and settle claims faster.

By combining traditional wisdom with modern technology, Kshema bridges the gap between the field and the future. It’s not just an app—it’s a partner in your farming journey.

Why Crop Insurance Matters in the Rabi Season:

Rabi crops are highly sensitive to sudden temperature drops and hail. A single night of frost can severely damage wheat or mustard fields. Crop insurance protects farmers from financial loss, supports recovery and helps maintain cash flow for the next season.

Key Crop Insurance Benefits

- Risk Mitigation: Protects against yield loss due to unforeseen events.

- Financial Stability: Ensures income continuity even in adverse seasons.

- Credit Access: Insured farmers are more likely to receive loans from banks and financial institutions.

- Peace of Mind: Reduces stress and uncertainty, allowing farmers to focus on productivity.

Despite these benefits, many farmers remain uninsured due to lack of awareness, complex procedures, or mistrust in the system. This is where Kshema General Insurance steps in to simplify and streamline the process.

Crop Insurance Policies by Kshema

Kshema offers crop insurance solutions that are affordable and tailored to the needs of Indian farmers. Here’s how Kshema is redefining crop insurance:

- Easy Enrolment Through the Kshema app, farmers can browse available insurance plans, compare benefits, and enrol with just a few taps. No long queues, no paperwork.

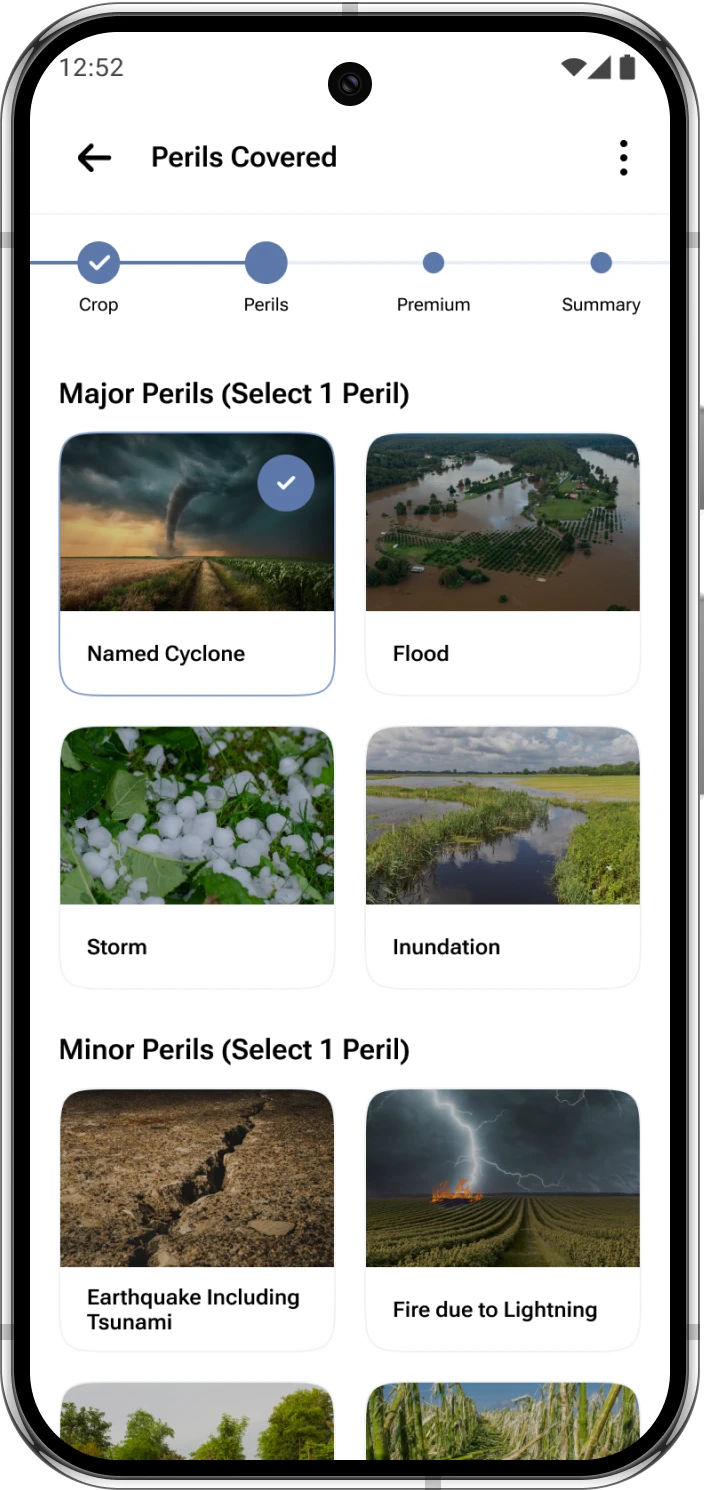

- Customised Coverage Policies are designed based on crop type, region, and risk profile. Whether you’re growing wheat in Punjab or mustard in Rajasthan, Kshema ensures you get the right protection. You can customise your protection by choosing 2 out of 8 perils that you want your crops to have protection from.

- Affordable Premiums Kshema Sukriti crop insurance policy starts at just INR 499/acre.

- Transparent Claims Process In the unfortunate event of crop loss, Kshema facilitates a smooth and transparent claims process. Farmers can upload photos, GPS-tagged data, and other evidence directly through the app, speeding up claim approvals.

- Real-Time Support Kshema’s support team is available to guide farmers through every step—from policy selection to claim settlement—ensuring a hassle-free experience.

Conclusion: Secure Your Rabi Season with Confidence

The Rabi season offers strong yield potential when farmers get the timing, irrigation and risk planning right. With tools like the Kshema app and reliable crop insurance, farmers can protect their wheat, mustard and gram fields from unexpected winter weather.

Secure your Rabi 2025 season with the right coverage today. Download the Kshema App or visit the PMFBY portal to apply for crop insurance and protect your farm in 2025.

Trusted References

- The Pradhan Mantri Fasal Bima Yojana (PMFBY) portal provides official crop insurance coverage details for Rabi crops.Official PMFBY Portal

- The Ministry of Agriculture & Farmers Welfare oversees seasonal crop insurance implementation in India.Official Agriculture Source

Frequently Asked Questions on Rabi Season in India

1. What is the Rabi season?

It is the winter cropping period in India when crops are sown after monsoon retreat (Oct–Dec) and harvested in spring (Feb–Apr).

2. When does the Rabi season start?

The season typically starts in October once rainfall reduces and temperatures drop.

3.What are the main Rabi season crops?

Major Rabi crops include Wheat, mustard, barley, gram, peas and oats.

4. Why do farmers need Rabi crop insurance?

Rabi crops are sensitive to frost, cold waves, hail and unseasonal rain. Insurance protects farmers from financial loss.

5. When should farmers enrol?

Immediately after sowing, within the official notification window.