How Crop Rotation Practices Strengthen Farming and Align with Insurance Policies in 2025

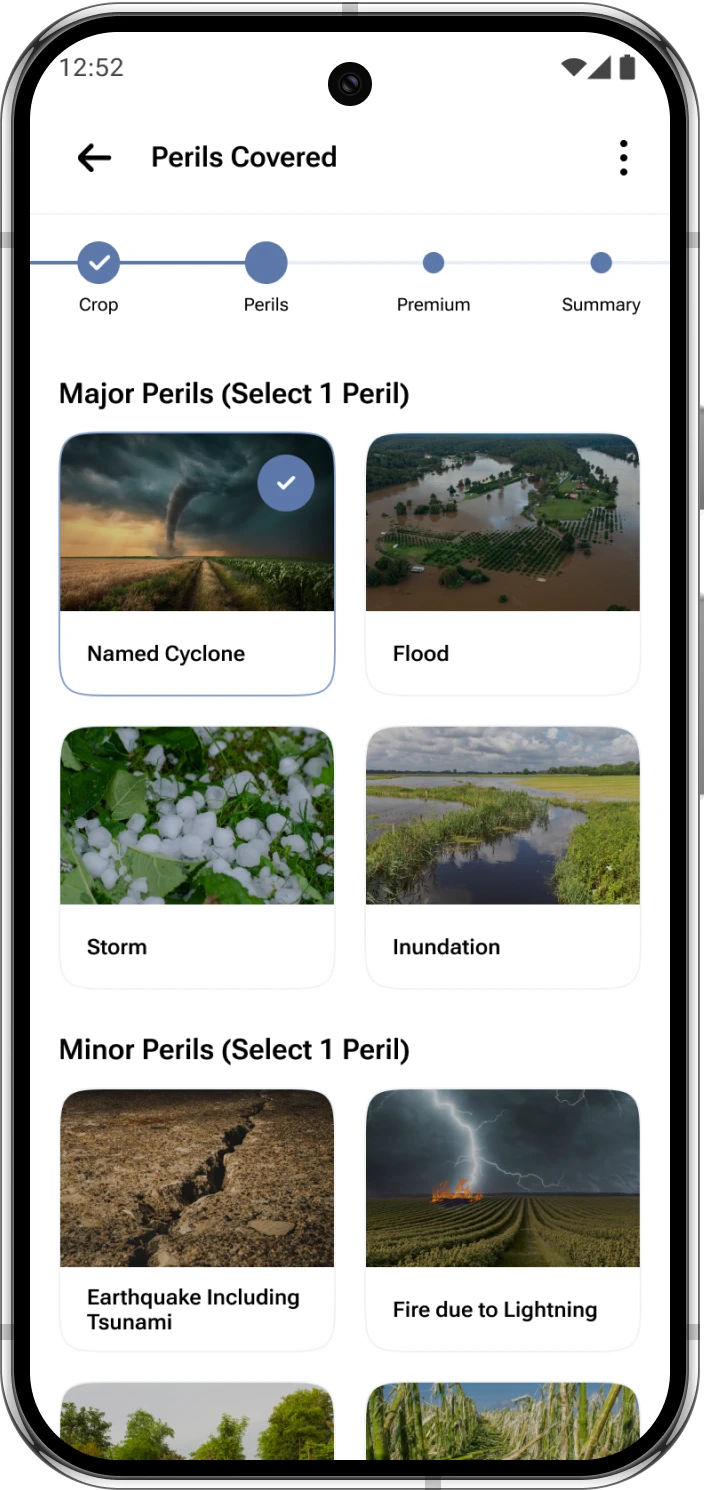

- Buy in easy steps

- Premium Starts at INR 499

- Protect 100+ Crops

- Quick & Easy Claims

Understanding Crop Rotation and Its Benefits

- Soil Health: Different crops have varying nutrient needs. Rotation helps restore soil nutrients and avoid depletion.

- Pest and Disease Management: It prevents pests and crop diseases from building up in the soil.

- Sustainability: This approach contributes to sustainable farming practices by reducing reliance on synthetic fertilisers and pesticides.

The Importance of Aligning Crop Rotation with Insurance Policies

How Insurance Policies Relate to Crop Rotation

Insurance providers assess risk when underwriting crop policies. Certain crop rotation practices, such as not rotating crops for extended periods or growing a non-insurable crop, can increase the risk of damage and lead to a policy violation.

Key Steps to Ensure Alignment Between Crop Rotation and Insurance Policies

Aligning crop rotation with insurance policies isn’t complicated, but it requires careful planning. Here are the key steps you should take:

Step 1: Review Your Insurance Policy

Carefully read your crop insurance policy. Most policies outline specific requirements about crop types, rotation frequency, and the maximum number of consecutive seasons a crop can be planted in the same field. Be aware of any exclusions or limitations related to crop rotation.

Step 2: Understand Crop Eligibility

Not all crops are insurable, and some policies may restrict the rotation of certain varieties. For example, some specialty produce may not be covered under standard insurance. Before planning your seasonal strategy, make sure that each item you intend to grow is covered.

Step 3: Monitor Rotation Requirements

Some insurers may offer discounts if you diversify crops regularly. This helps mitigate risks. Make sure you follow the guidelines to maintain your coverage. Typically, this could mean alternating between legumes, grains, and other plant categories.

Step 4: Maintain Records

Insurers may ask for documentation proving that you’re following a proper field management plan. Keep detailed records of crop schedules, crop types, and any changes you make. This will help in the event of a claim.

Consult Your Insurance Advisor

Your advisor can be a valuable resource in understanding how your planting practices affect your premium or coverage. They can clarify which crops are eligible, provide guidance on rotation timelines, and offer risk management advice. Regular consultations are especially helpful when changing your farming approach.

Potential Risks of Misalignment

- Higher Premiums: Non-compliance can lead to increased premiums or even a loss of coverage.

- Farm Sustainability Risks: Poor planning not only affects your insurance but may also harm the land, impacting productivity and profits.

Common Misconceptions About Crop Rotation and Insurance

There are several misunderstandings surrounding this topic. Let’s clear up a few:

Myth 1: Rotating crops doesn’t affect insurance.

Fact: Insurers often limit the number of years the same crop can be planted in a field. Failure to switch can reduce coverage.

Myth 2: Any crop can be rotated without issue.

Fact: Some may be ineligible for coverage under specific policies. Always check before introducing a new variety.