Top 10 Benefits of Crop Insurance for Farmers: Financial Security, Risk Protection & Growth

Summary: Crop insurance protects farmers from financial loss due to natural disasters, pests, and crop failure. It ensures income stability, encourages investment, and supports sustainable agriculture.

- Buy in easy steps

- Premium Starts at INR 499

- Protect 100+ Crops

- Quick & Easy Claims

The agricultural sector today faces significant uncertainty. For this reason, crop insurance for farmers has become an essential tool for protecting livelihoods and ensuring financial stability. When rains arrive late, floods hit the field or pests spread fast, months of hard work can be lost in days. Crop insurance is a safety net for these moments. In this simple guide, we explain the top 10 benefits of crop insurance for farmers in India.

You will see the importance of agricultural insurance for protecting income, getting easier bank credit, reducing debt stress and preparing for the next season. Whether you grow paddy, wheat, pulses, cotton or horticulture crops, this will help you plan Kharif and Rabi with more confidence.

What Is Crop Insurance and Why Do Farmers Need It?

Crop insurance protects your farm income when nature or pests damage your crop. If a covered event like drought, flood, hail or a pest attack harms the field, you may receive a payout as per the policy. This money helps manage family needs, repay loans and buy seeds, fertiliser and labour for the next sowing.

With changing weather and rising input costs, one bad season can cause heavy loss. Insurance reduces that shock so your plans continue. Think of it as a guard for your cash flow, not just a formality.

How Crop Insurance Works in Simple Terms

The process is straightforward. You enrol for the season, pay the premium and keep your sowing proof and documents safe. If damage occurs due to a covered risk, inform within timelines and keep basic evidence ready. Assessments are done as per the policy process, and approved claims are paid into your bank account.

Digital tools now make enrolment, status updates and alerts easier. The goal is simple: reduce the financial hit from natural events so you can recover and prepare for the next crop.

Top 10 Benefits of Crop Insurance for Farmers

1. Income protection after weather damage

Unseasonal rain, drought or hail can reduce yield or spoil the harvest. A valid payout helps cover urgent expenses repairing bunds, buying seed and fertiliser, hiring labour and keeping the household running. This support lets you restart quickly instead of pausing farming plans. It keeps cash flow steady so one bad spell does not become a full‑year setback.

2. Risk cover across the crop season

Farming risks vary by month. In Kharif, delayed monsoon or heavy downpours can hit paddy or cotton; in Rabi, late rain or hail may affect wheat close to harvest. Insurance recognises season‑wise risks. When a covered event occurs, you have financial support to manage losses and move to the next stage.

3. Better access to bank credit

4. Confidence to invest in quality seeds and inputs

5. Support to restart the next sowing

6. Lower debt stress for families

7. Encourages modern and sustainable practices

8. Community resilience and local jobs

9. Simple digital enrolment and updates

10. Peace of mind for long‑term planning

One of the primary benefits of crop insurance is the financial security it offers to farmers. With guaranteed compensation for potential losses, farmers can plan their investments and operations with greater confidence. This safety net is crucial for maintaining a stable income and supporting their families, even in adverse conditions.

This financial security allows farmers to reinvest in their farms, adopt better practices, and purchase necessary equipment without the fear of financial ruin.

How Does Crop Insurance Help Mitigate Agricultural Risks?

Crop insurance plays a vital role in agricultural risk mitigation. Crop insurance, with coverage against risks like natural disasters, pests, and diseases, is an ideal tool for managing uncertainty.

This allows them to focus on improving their farming practices without the constant fear of losing their crops. By reducing the financial impact of these risks, crop insurance enables farmers to experiment with new techniques and innovations, boosting their productivity and resilience.

Does Crop Insurance for farmers Cover Natural Disasters?

Natural disasters such as floods, landslides, and storms can devastate crops and lead to significant financial losses. Crop insurance provides essential protection against these events.

Crop insurance helps farmers quickly recover from financial crises caused by crop damage or loss, allowing them to resume production with minimal disruption to the next crop cycle.

This protection is crucial in regions prone to severe weather, where the risk of crop failure is high and the financial impact can be devastating.

How Does Crop Insurance Encourage Better Farming Practices?

The benefits of crop insurance extend beyond financial compensation. It also promotes the adoption of better agricultural practices. Insured farmers are more likely to invest in high-quality seeds, fertilizers, and advanced farming techniques, knowing crop insurance backs them with a safety net.

This, in turn, leads to higher productivity and better crop quality, benefiting the entire agricultural sector. Crop insurance encourages farmers to diversify crops, reducing monoculture risks and boosting farm resilience.

What Types of Crops Are Covered Under Crop Insurance?

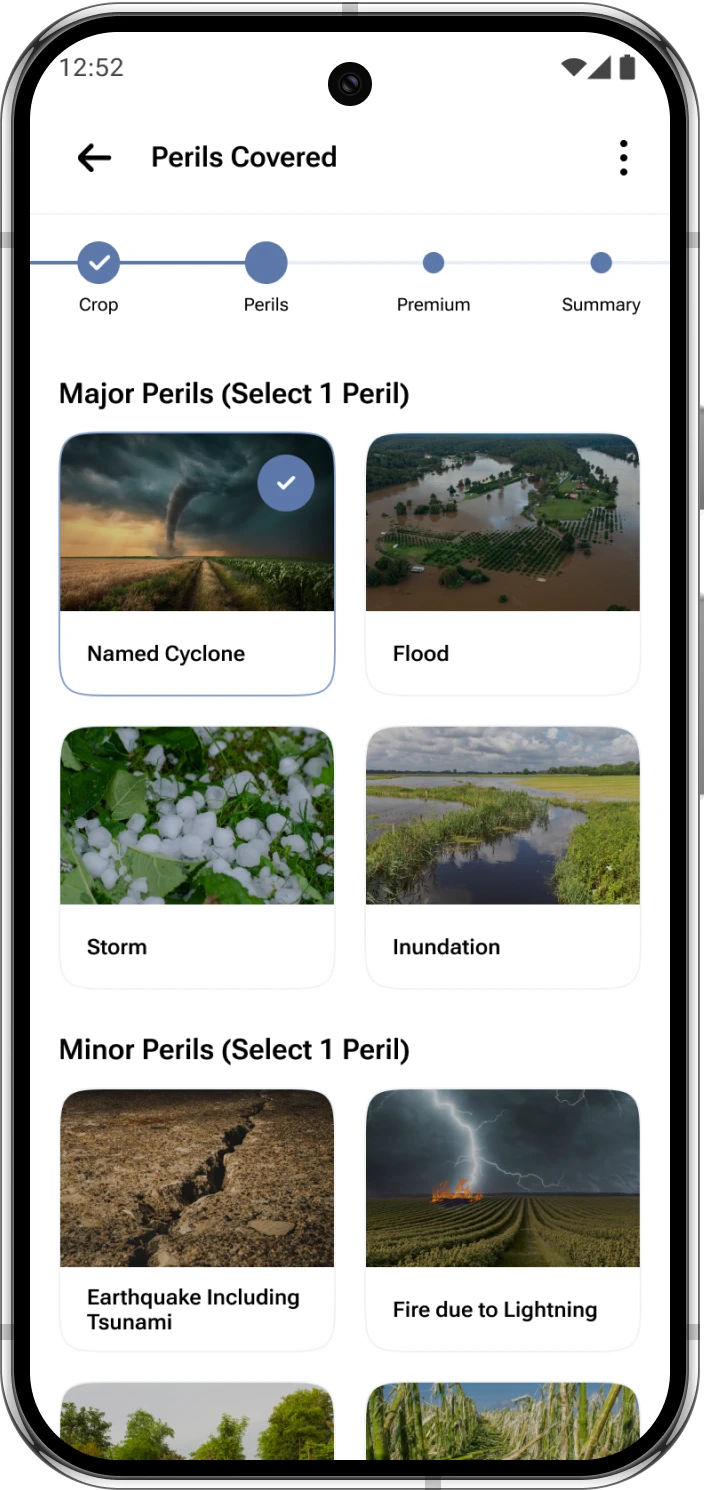

Crop insurance policies are designed to provide coverage for a wide variety of crops. This flexibility ensures farmers can find a policy tailored to their specific needs and circumstances.

Crop insurance provides the necessary coverage to both marginal and commercial farmers to protect their investments that go into farming. This tailored approach helps farmers tackle their unique challenges and ensures they receive the right level of protection for their specific agricultural needs.

How Does Crop Insurance Reduce Overall Agricultural Risk?

Crop insurance plans, by diversifying financial risks, play a key role in reducing overall agricultural risk.

It allows farmers to share the burden of potential losses with insurance providers, easing the financial impact of adverse events. This collective approach to risk management financially strengthens the agricultural community and promotes long-term viability.

Can Crop Insurance Improve Financial Stability for Farmers?

Crop insurance offers a stable financial environment for farmers, enabling them to manage their resources more efficiently. With the assurance of compensation for potential losses, farmers can secure loans more easily, invest in improved farming practices, and plan for future growth.

This financial stability is key to the feasibility and development of the agricultural sector. Furthermore, financial stability allows farmers to withstand economic downturns and market fluctuations more effectively, ensuring the continuation of their farming operations and long-term success.

Does Crop Insurance Protect Farmers’ Income?

Crop insurance ensures a steady income for farmers, even in times of crop failure or market fluctuations. By providing compensation for lost or damaged crops, it helps maintain their income levels and supports their financial well-being. This income protection is crucial for small-scale farmers who depend on agricultural produce for their livelihood and the opportunity to improve their quality of life.

Read also: How Does Crop Insurance Work? Understanding the Basics and Benefits for Farmers

Most crop insurance programs are part of broader support initiatives designed to strengthen the agricultural sector’s resilience. These programs often include services such as technical assistance, training, and access to resources, helping farmers improve productivity and sustainability.

Crop insurance can therefore be an integral part of a larger system that combines various support mechanisms with a holistic approach to agricultural development.

How Does Crop Insurance Encourage Agricultural Investment?

The security provided by crop insurance serves as an incentive for farmers to increase investment in agricultural activities. Knowing their investments are protected, farmers are more likely to adopt innovative farming techniques, diversify crops, and expand their operations.

Increased investment boosts productivity, improves crop quality, drives overall growth in the agriculture sector, and enhances farmers’ income.

What Are the Limitations of Crop Insurance and How Can They Be Addressed?

While crop insurance provides many benefits, it also has limitations such as delayed claim settlements, lack of awareness among farmers, and limited coverage in some regions. Addressing these challenges is essential to maximize the effectiveness of agricultural insurance.

Conclusion

Crop insurance offers numerous advantages that are crucial for the financial security and stability of farmers.

From protecting against income loss caused by natural disasters to encouraging investment in agriculture, the benefits of crop insurance are extensive and vital for the agricultural community.

Kshema recognises the value of crop insurance in ensuring that a farmer’s livelihood is protected.

We have developed industry-first crop insurance products, such as Kshema Sukriti and Kshema Prakriti, to offer comprehensive coverage and support to farmers across the nation.

Our platform enables farmers to easily access insurance policies tailored to their specific needs, ensuring comprehensive protection against various risks.

Kshema is committed to supporting farmers and securing their future.

Key Takeaway:

Crop insurance is essential for protecting farmers’ livelihoods, ensuring income stability, and promoting agricultural growth. Kshema’s innovative products like Sukriti and Prakriti offer tailored solutions to meet farmers’ needs.