For farmers, every season brings new and myriad challenges — from unpredictable weather to market fluctuations. In such uncertain conditions, crop insurance serves as a financial safety net, ensuring that losses don’t turn into long-term setbacks. However, simply purchasing a policy is not enough. It is equally important to regularly check your crop insurance status to ensure your coverage remains valid and effective.

- Buy in easy steps

- Premium Starts at INR 499

- Protect 100+ Crops

- Quick & Easy Claims

In this blog, we’ll discuss why tracking your insurance status is essential, how it helps in smooth claim settlements, and the best ways to stay updated.

1. Crop Insurance is Season-Based – Renew It Every Sowing Cycle

Unlike life insurance which offers long-term coverage, crop insurance is season-based. Farmers must purchase a new policy every sowing season to ensure their crops remain protected.

Many farmers assume that once they have bought crop insurance, they are covered for the entire year. However, each policy only applies to a specific cropping season (Kharif or Rabi). If you do not renew your crop insurance by the cutoff date for a new crop season, you may be left without financial protection against crop loss.

By regularly checking your crop insurance status, you can:

- Ensure you have renewed your policy when the sowing begins.

- Avoid missing deadlines for premium payments.

- Stay protected against perils like flood, cyclone, animal attacks, etc.

Don’t assume that last season’s policy is still active—always verify and renew your insurance at the start of every crop cycle.

Why Crop Insurance in India is Essential for Small and Marginal Farmers

- Protection Against Uncertainties Farmers are at the mercy of nature, more so in a country like India, and adverse weather can wipe out their crops. Crop insurance in India provides financial support during such losses, ensuring that farmers can recover and prepare for the next sowing season.

- Financial Stability A single crop failure can push small and marginal farmers into debt or force them to sell their assets. Crop insurance in india offers protection, enabling them to sustain their livelihoods without resorting to desperate measures.

- Mitigating Debt Dependency Many small farmers rely on informal credit sources that charge exorbitant interest rates. Crop insurance reduces this dependency by creating a financial safety net with the money received as part of the claim settlement process providing aid during distress.

- Long-Term Sustainability Crop insurance also incentivises farmers to adopt and invest in modern, and sustainable farming practices by taking away the fear of financial loss, reducing risks in the long run.

Benefits of Crop Insurance in India for Small and Marginal Farmers

- Comprehensive Coverage: Crop insurance in India covers losses due to natural calamities, and even wild animal attacks.

- Affordable Premiums: Crop insurance products like Kshema Sukriti make crop insurance affordable even for marginal farmers.

- Protection from Income Shocks: Settlement of insurance claims safeguards the financial interest of the farmers by ensuring they have access to resources to continue farming.

- Empowerment: Crop insurance in India instills confidence in farmers, empowering them to focus on improving productivity rather than worrying about risks.

- Boosts Rural Economy: When farmers are financially secure, they can contribute to the rural economy by investing in inputs, machinery, and labour.

How Crop Insurance Schemes Work in India

- Enrollment: Farmers can enroll in crop insurance schemes in India through banks, insurance companies, Common Service Centers (CSCs) or mobile apps. They must provide details about their land, crops, Aadhaar, etc.

- Premium Payment: Farmers pay a small premium against a sum insured for their insured crop.

- Loss Reporting: In the event of crop loss, farmers report the damage to their insurance provider or local authorities. They can upload photos and/or videos of the crop damage to report loss.

- Claim Settlement: After verification, the insurer processes the claim and disburses the settlement to the farmer.

Role of Kshema General Insurance in Safeguarding the Small and Marginal Farmers

Our Key Offerings Include:

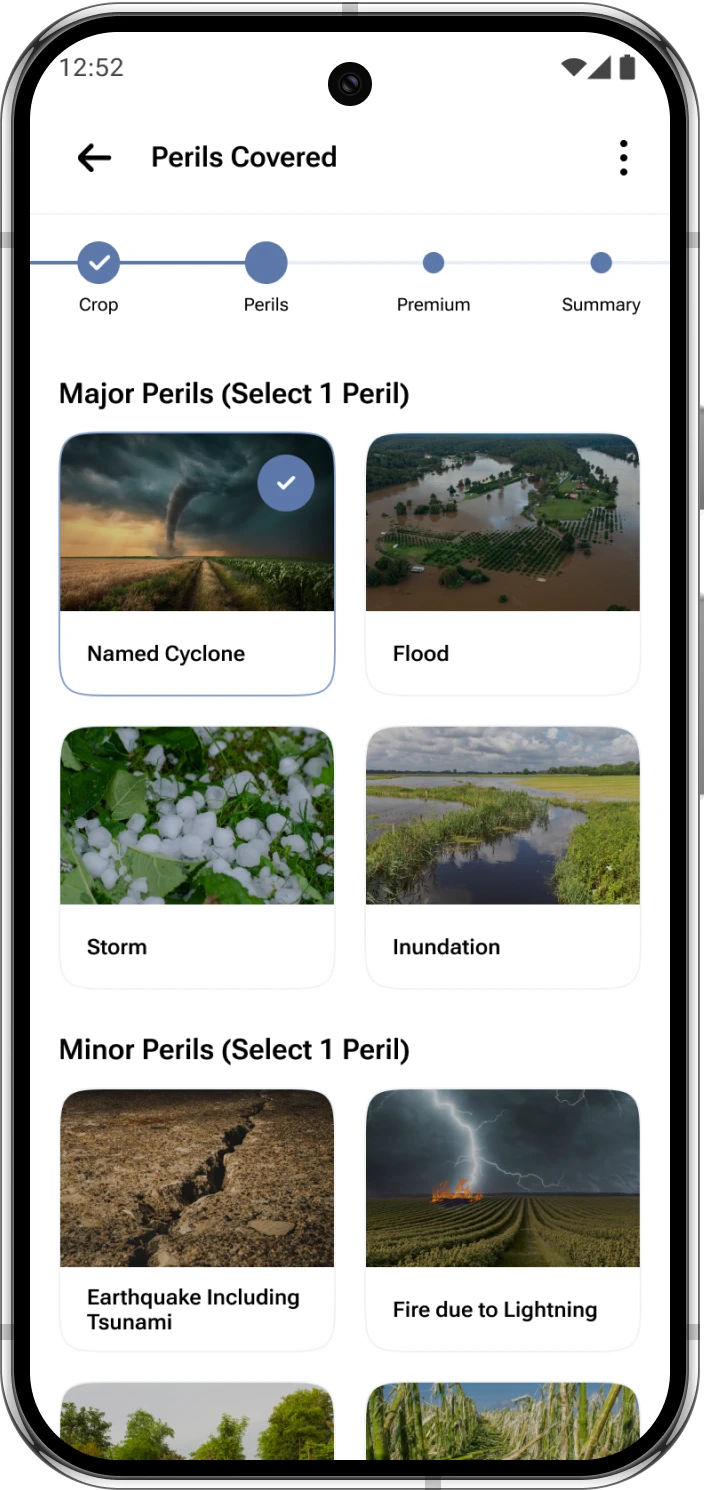

- Comprehensive or customisable protection against losses caused by 8 perils.

- Coverage for damage caused by wild animals like elephants, wild boars, monkeys, and rabbits.

- Simplified enrollment and claims processes using the Kshema app to ensure ease of access for farmers.