Agriculture is India’s major economic activity with approximately 55 percent of its workforce engaged in agriculture or allied activities while small and marginal farmers constitute over 85% of this population. These farmers, owning less than 5 acres of land, play a vital role in ensuring the nation’s food security. However, they are also most vulnerable to risks, including unpredictable weather and fluctuating market prices. For such small farmers, protection is crucial because even a single crop failure can lead to devastating financial losses.

- Buy in easy steps

- Premium Starts at INR 499

- Protect 100+ Crops

- Quick & Easy Claims

In this context, crop insurance in India is a lifeline, providing small farmers with the necessary protection and financial stability. This blog delves into why crop insurance is essential for small and marginal farmers, its benefits, and its transformative role for rural India.

The Challenges Faced by Small and Marginal Farmers

Small and marginal farmers in India face a range of challenges that threaten their livelihoods:

- Unpredictable Weather: With climate change, events such as cyclones, floods, hailstorms, unseasonal rainfall etc. have become more frequent and severe.

- Pests and Diseases: Crops are susceptible to pest infestations and diseases, which can destroy entire crops.

- Rising Input Costs: Seeds, fertilisers, and pesticides have become costlier, increasing production expenses for farmers.

- Market Instability: Farmers are often forced to sell their produce at lower prices due to market fluctuations and lack of bargaining power.

- Debt Traps: Without adequate financial security, farmers are compelled to take loans, often at high interest rates, leading to debt cycles.

These challenges highlight the critical need for safeguards like crop insurance to protect small farmers from financial ruin. By paying a nominal premium, farmers can ensure that they receive their claims in the event of a crop failure.

Why Crop Insurance in India is Essential for Small and Marginal Farmers

1. Protection Against Uncertainties

Farmers are at the mercy of nature, more so in a country like India, and adverse weather can wipe out their crops. Crop insurance in India provides financial support during such losses, ensuring that farmers can recover and prepare for the next sowing season.

2. Financial Stability

A single crop failure can push small and marginal farmers into debt or force them to sell their assets. Crop insurance in india offers protection, enabling them to sustain their livelihoods without resorting to desperate measures.

3. Mitigating Debt Dependency

Many small farmers rely on informal credit sources that charge exorbitant interest rates. Crop insurance reduces this dependency by creating a financial safety net with the money received as part of the claim settlement process providing aid during distress.

4. Long-Term Sustainability

Crop insurance also incentivises farmers to adopt and invest in modern, and sustainable farming practices by taking away the fear of financial loss, reducing risks in the long run.

Benefits of Crop Insurance in India for Small and Marginal Farmers

- Comprehensive Coverage: Crop insurance in India covers losses due to natural calamities, and even wild animal attacks.

- Affordable Premiums: Crop insurance products like Kshema Sukriti make crop insurance affordable even for marginal farmers.

- Protection from Income Shocks: Settlement of insurance claims safeguards the financial interest of the farmers by ensuring they have access to resources to continue farming.

- Empowerment: Crop insurance in India instills confidence in farmers, empowering them to focus on improving productivity rather than worrying about risks.

- Boosts Rural Economy: When farmers are financially secure, they can contribute to the rural economy by investing in inputs, machinery, and labour.

- Enrollment: Farmers can enroll in crop insurance schemes in India through banks, insurance companies, Common Service Centers (CSCs) or mobile apps. They must provide details about their land, crops, Aadhaar, etc.

- Premium Payment: Farmers pay a small premium against a sum insured for their insured crop.

- Loss Reporting: In the event of crop loss, farmers report the damage to their insurance provider or local authorities. They can upload photos and/or videos of the crop damage to report loss.

- Claim Settlement: After verification, the insurer processes the claim and disburses the settlement to the farmer.

Role of Kshema General Insurance in Safeguarding the Small and Marginal Farmers

At Kshema General Insurance, we recognise the vital role of small and marginal farmers in India’s agricultural landscape. Our crop insurance solutions are tailored to meet the unique challenges faced by these farmers, offering them the financial security they deserve.

Our Key Offerings Include:

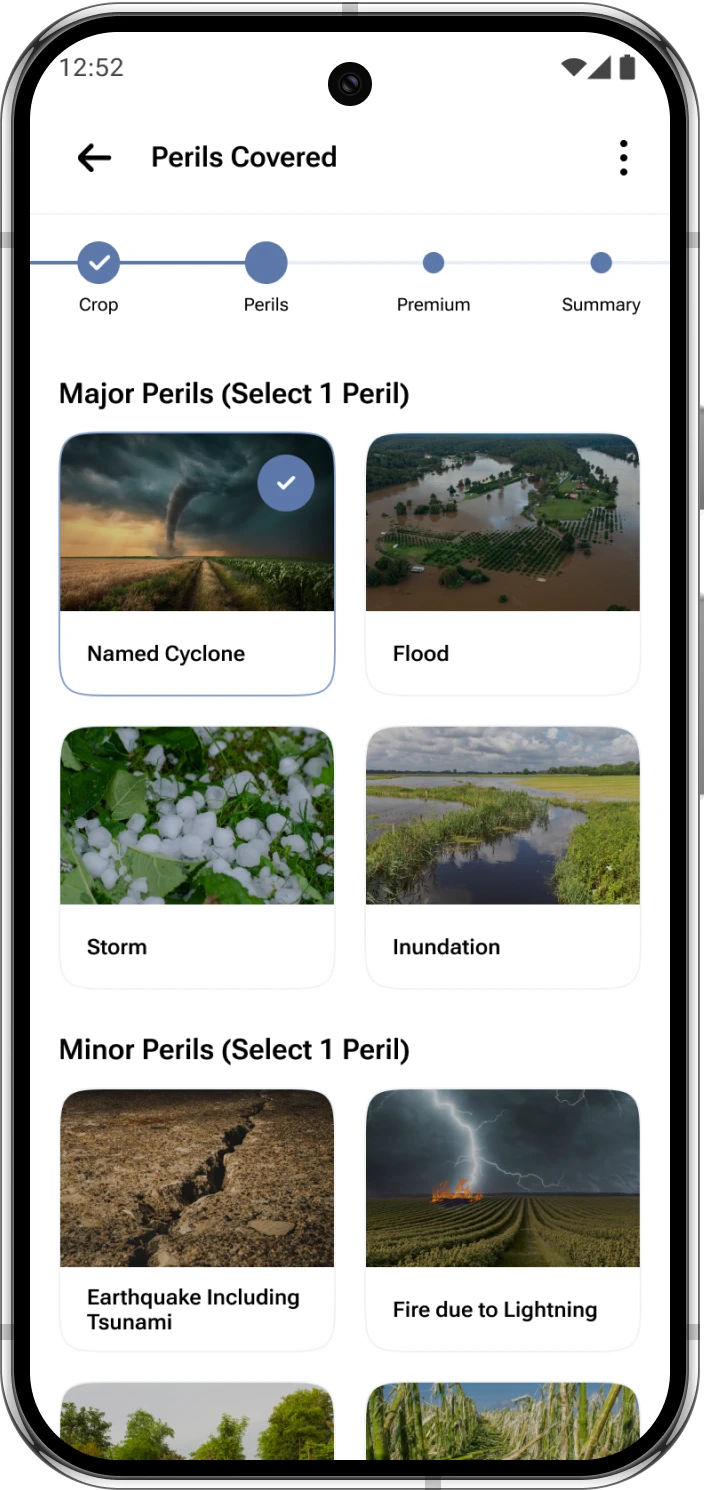

- Comprehensive or customisable protection against losses caused by 8 perils.

- Coverage for damage caused by wild animals like elephants, wild boars, monkeys, and rabbits.

- Simplified enrollment and claims processes using the Kshema app to ensure ease of access for farmers.

Also Read: https://kshema.co/how-crop-insurance-can-safeguard-small-farmers-livelihoods/

Conclusion

Crop insurance in India is not just a financial product, it is a lifeline that ensures small and marginal farmers can continue farming despite challenges. By protecting them from financial losses, crop insurance plays a crucial role in promoting sustainable agriculture and rural development.

At Kshema General Insurance, we stand by Indian farmers, offering them the tools and support they need to thrive. If you are a farmer looking to secure your crops and livelihood, explore our crop insurance solutions today. Let’s work together to build a resilient farming community for a better tomorrow.

Frequently Asked Questions (FAQs)

Q1. Why integrate protection with insurance?

Protection lowers incident risk; insurance compensates when events still occur.

Q2. Which solutions are effective?

Biological controls, timely sprays, netting, and soil health improvements.

Q3. Does integrated pest management reduce premiums?

Not directly, but fewer claims and healthier crops improve profitability.

Q4. Can advisory services help?

Yes. Tailored agronomy advice optimizes timing and dose of interventions

Q5. How to start integration?

Audit current risks, adopt practical safeguards, and secure the right insurance cover.