How Mobile Apps Make Crop Insurance Easier for Farmers

Mobile apps for crop insurance are helping farmers access protection quickly and easily, without paperwork or office visits. With changing weather, rising risks and busy farming schedules, digital crop insurance has become essential for small farmers. In this guide, we explain how mobile apps for crop insurance make buying policies, filing claims and tracking updates simple and farmer friendly.

- Buy in easy steps

- Premium Starts at INR 499

- Protect 100+ Crops

- Quick & Easy Claims

1.Easy Access with Mobile Crop Insurance Apps

- Quick Policy Access: With a few taps, farmers can instantly access their crop insurance policies, including coverage details, premiums, and exclusions. This convenience ensures farmers have the information on their fingertips when they want it and where they want it.

- Real-Time Updates: Mobile apps allow farmers to receive real-time updates about their insurance policies. Whether it’s a change in policy terms or an update on weather conditions affecting crops, the app keeps farmers informed, ensuring they don’t miss important information.

2.Convenience and Time-Saving

- No Need for Physical Visits: With mobile apps, there’s no need to visit insurance offices. Farmers can access all the services they need from their smartphones, saving valuable time and money. Whether it’s applying for insurance, making a claim, or updating their policy, everything can be done remotely

- Fast Registration and Claims Processing: Mobile apps simplify the process of registering for crop insurance. They also streamline the claims process Farmers can submit claims directly through the app, upload photos of damaged crops, and track the status of their claims, all without waiting for an insurance agent to process them manually.

3.Affordable Crop Insurance Plans via Mobile Apps

- Lower Premiums via Mobile Apps: Mobile apps allow insurance providers to cut down on overhead costs, which can result in lower premiums for farmers. By reducing administrative costs, these apps make crop insurance more affordable, ensuring that even small-scale farmers can protect their crops without breaking the bank.

- Cost-Effective Plans for Small Farmers: Insurance companies understand the financial challenges faced by small farmers. Mobile apps make it easier to offer customised plans that cater to their specific needs, making insurance more cost-effective and aligned with their budget.

4. Enhanced Accuracy and Data Collection

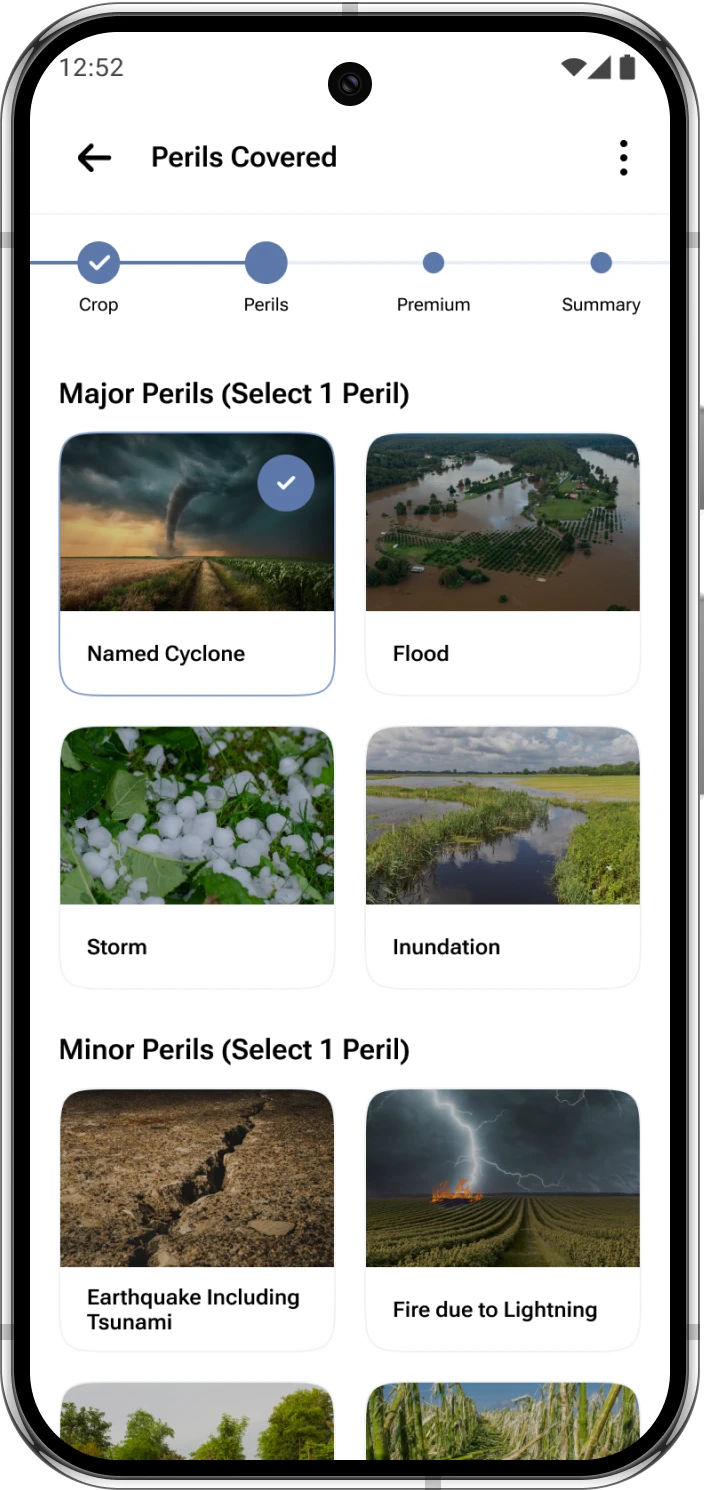

- Precision in Crop Data Collection: Mobile apps allow farmers to feed input detailed data about their crops directly into the app. This data can include the size of the farm, crop types, and even soil conditions, ensuring that insurance providers have the most accurate information available. This leads to better coverage and claims processing.

- Integration with Weather Forecasts: Many mobile crop insurance apps are integrated with weather forecast services. By providing real-time weather updates and predictions, these apps help farmers assess risks and protect their crops before bad weather strikes, ensuring they’re adequately covered.

5. Better Risk Management and Decision-Making

- Risk Assessment Tools: Mobile apps for crop insurance often include risk assessment tools that allow farmers to evaluate the likelihood of a crop failure or other risks. This information helps farmers make proactive decisions about which crops to plant and when to insure them.

- Personalised Recommendations: Many mobile apps also offer personalised recommendations based on the farmer’s specific needs. This includes guidance on the best insurance plans, the extent of coverage to choose, and ways to reduce risks, helping farmers make better decisions for their business.

Best Crop Insurance Apps in India 2025

Best Crop Insurance Apps in India for Farmers

Why Small Farmers Prefer Mobile Apps for Crop Insurance

How Mobile Apps Streamline the Claims Process

- Instant Notifications and Updates: Once a claim is submitted, farmers receive instant notifications through the app. This allows them to track their claim in real time and stay updated on its progress. No more waiting for calls or emails from insurance agents.

- Quick and Transparent Payouts: With mobile apps, farmers can also benefit from quicker payouts. The app’s streamlined process ensures that claims are processed more efficiently, providing transparency and reducing the time it takes for farmers to receive compensation for their losses.

The Role of Mobile Apps in Modern Farming

- Bridging the Gap Between Technology and Agriculture: Mobile apps allow farmers to access the latest farming technologies, making it easier for them to stay competitive in an ever-changing market. From crop insurance to weather forecasting, these apps provide valuable tools for modern farming.

- Future Potential of Mobile Crop Insurance Apps: As technology continues to evolve, mobile crop insurance apps will only become more sophisticated. Farmers can look forward to even more personalised coverage options, improved risk management tools, and seamless claims processing in the future.

How to Get Started with Mobile Crop Insurance Apps

- Choose an App: Research the top apps for crop insurance and choose one that suits your needs.

- Download the App: Install the app from your phone’s app store.

- Sign Up: Create an account by entering your personal and farm details.

- Select a Plan: Choose the insurance plan that works best for you.

- Submit Claims: If necessary, submit claims through the app, upload photos, and track the process.

Conclusion

Mobile apps for crop insurance are transforming how farmers protect their crops. From easy policy access to quicker claim settlements, these digital tools save time, reduce stress and provide strong financial protection. The Kshema App offers farmers an easy way to compare plans, buy cover and track claims—all from their phone. For safer farming and better income security, switching to mobile based crop insurance is a smart step for every farmer.

Frequently Asked Questions on Mobile Apps for Crop Insurance

1. What is a mobile app for crop insurance?

A mobile app lets farmers buy crop insurance, file claims and track policy details digitally.

2. Which is the best crop insurance app in India?

Apps like PMFBY and private platforms like Kshema offer easy policy access and claim support.

3. How do mobile apps help farmers with crop insurance?

They reduce paperwork, speed up claims and provide real time policy updates.

4. Do farmers need crop insurance apps?

Yes, apps save time, simplify enrolment and help farmers stay protected from weather risks.

5. How can a farmer start using a crop insurance app?

Download the app, register with basic details, choose a plan and submit documents digitally.